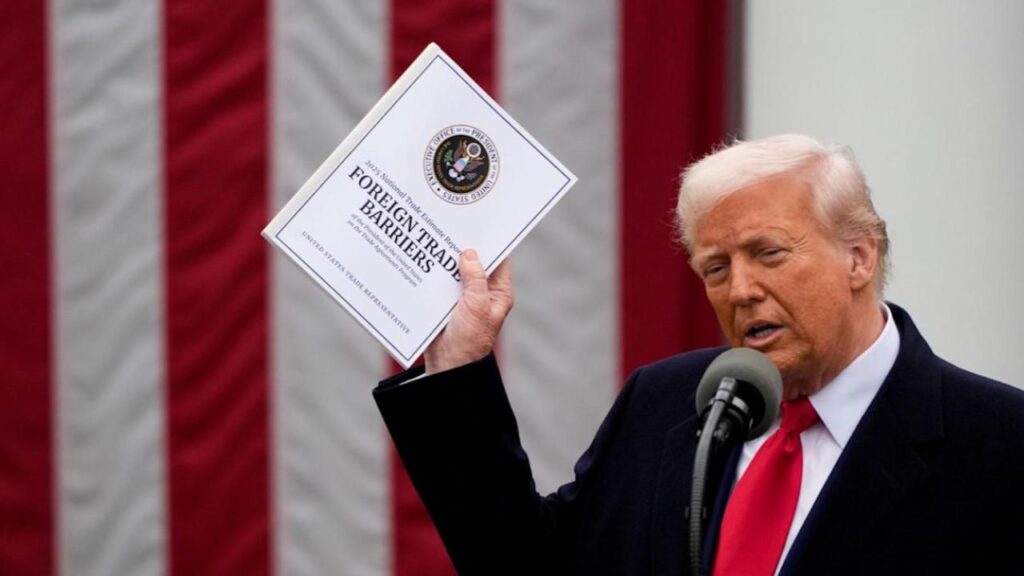

Donald Trump’s latest headline-grabbing policy—dubbed the “revenge tax”—could reshape global capital flows and threaten the economic footing of the U.S. This move, packaged in the so‑called “One Big Beautiful Bill Act” places extra levies on foreign companies and investors from nations seen as taxing U.S. tech firms unfairly. Here’s what you need to know—and why it matters.

Will His ‘Revenge Tax’ Push Billions Out of America?

| Insight | Stat |

|---|---|

| Potential GDP hit | May reduce U.S. GDP by $100 billion annually |

| Job losses | Up to 700,000 U.S. jobs at risk |

| Debt impact | Could add $3 trillion to debt over 10 years |

Trump’s “revenge tax” is a bold, combustible policy tool—intended as economic tit‑for‑tat but fraught with risk. Its fallout could erode investment, drag on the economy, and hobble U.S. global economic influence. As negotiations unfold, keeping a close eye on Section 899’s path through Congress—and its real-world fallout—is critical.

What Is the Revenge Tax?

Section 899 in Trump’s bill proposes a retaliatory tariff-style tax on income that foreign entities earn from U.S. sources—think dividends, royalties, interest or capital gains. It starts at 5%, rising to 20% by 2029. Its target: countries with digital services or “profit diversion” taxes aimed at U.S. firms. The goal? Level the playing field.

Why Investors Are Concerned

1. Capital Flight Risk

- Analysts warn this could drive away investment in U.S. markets and Treasury bonds.

- Even central banks and sovereign wealth funds may reduce U.S. purchases as a precaution.

2. GDP & Job Toll

- The EY QUEST study estimates a $100 billion annual GDP loss, and elimination of 700,000 U.S. jobs, largely hitting manufacturing and R&D.

3. Trade Friction & Dollar Risk

- Turning taxes into a geopolitical tool could fracture global trade, undercut multilateral tax diplomacy, and threaten the dollar’s “safe haven” status.

Proponents vs. Critics

Proponents Say:

- It compensates for hostile digital services taxes in places like France or the UK.

- Could level economic playing fields and raise $116 billion over the next period.

Critics Counter:

- Barclays and other investors argue concerns are overblown.

- Global think tanks, including Chatham House and UniCredit, caution it could weaken foreign investor sentiment.

🇺🇸 Why It Matters to Americans

I remember covering fiscal battles during prior administrations—there’s always a catch. Lower investment means fewer jobs and slower wage gains. With U.S. federal debt already surpassing $36 trillion, this could add more fiscal strain.

Middle- & Lower-Income Households

- Though targeted at foreign entities, lower investment could reduce economic opportunity for many, eroding social programs as budgets tighten.

Wealthy Households

- They might pocket tax break gains but could also face portfolio drag if markets tumble—capital isn’t immune.

What’s Next in Congress?

- The bill’s Senate fate is uncertain as midterm pressures loom and GOP moderates resist sweeping spending cuts.

- Legal questions remain: Is this a legitimate economic defense or overreach? Courts may need to weigh in.

Trump’s revenge tax is more than symbolic diplomacy. By penalizing foreign capital, the U.S. risks denting its own economic engine—potentially slowing GDP, stifling job growth, and rattling global trust. This isn’t just high-stakes politics; it’s a gamble with real-world consequences for everyday Americans.

FAQs

What countries are targeted?

Mostly nations imposing digital services taxes—like France, the UK, Germany, and Italy.

Will U.S. investors pay more?

No—this applies only to non-U.S. entities earning U.S.-source income, but the ripple effects could impact markets broadly.

Could foreign firms just move headquarters?

Yes. Firms might relocate to avoid the tax, reducing U.S. investment and undermining domestic job prospects.