The Federal Reserve and U.S. regulators just pivoted toward trimming bank leverage ratios—one of the strictest post-crisis safeguards. But what does that move mean for your savings, investments, and the economy at large? Here’s the inside scoop on the potential ripple effects—and what you should keep an eye on.

US Regulators Push to Slash Bank Leverage Ratios

| Takeaway | Stat/Fact |

|---|---|

| Regulators may lower enhanced SLR from 5% to 3.5–4.5% | Potential 1.5 pp cut |

| Banks say current rules hinder Treasury market liquidity | Industry concern raised repeatedly |

| SLR temporarily suspended for Treasuries during COVID‑19 | A backstop during crisis |

Regulators seem ready to trim the SLR—possibly removing up to 1.5 percentage points or excluding Treasuries altogether. If finalized, that could calm Treasury markets and ease borrowing costs. But circumspection abounds: this isn’t a done deal, and trade-offs remain. For average savers and investors, it’s a development worth tracking—but not time to overhaul your financial strategy—yet.

Why Leverage Ratios Matter

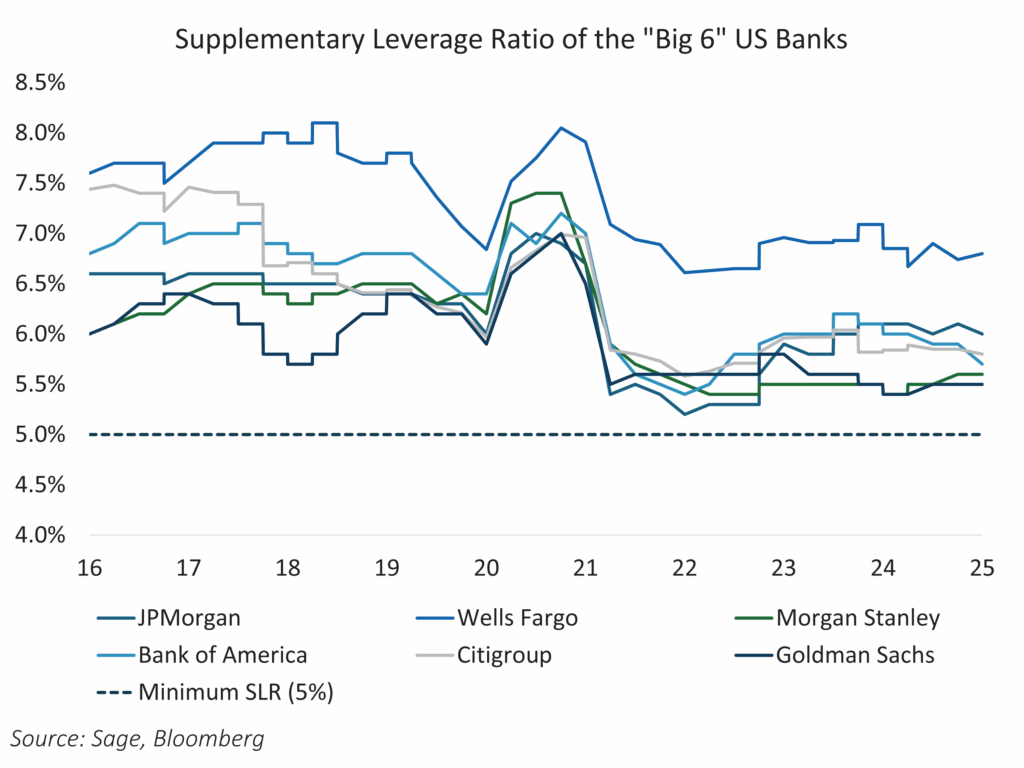

The Supplementary Leverage Ratio (SLR) requires major banks to hold capital equal to a percentage of their total assets—including low-risk holdings like U.S. Treasuries. Initially set at 5% for systemically important banks and 3% for large banks, the rule served as a protective backstop after 2008.

Banks argue that the rule has gone too far—especially during market stress when they’d like to buy Treasuries, but the SLR discourages them from doing so. The result? Tighter liquidity and thinner bidding in critical markets.

What’s Changing—and Why Now

On June 25, 2025, the Fed, FDIC, and OCC plan to discuss easing the enhanced SLR—a key topic since Fed Governor Michelle Bowman took office. Proposals include:

- Lowering the enhanced SLR from ~5% to 3.5–4.5%

- Possibly excluding Treasuries from leverage calculations (if regulators follow the 2020 COVID-style exemption route)

These moves aim to free up bank capacity to buy Treasuries, improving bond market liquidity and helping to lower borrowing costs for the federal government.

A Closer Look: What It Could Mean for You

1. Improved Treasury Market Liquidity

Banks would feel freer to hold and trade U.S. Government debt—helping reduce yield volatility in times of stress .

That could mean smoother Treasury auctions, and—by extension—lower interest rates across fixed-income assets.

2. Potentially Lower Yields

More bank participation could help nudge long-term yields lower. Treasury Secretary Scott Bessent tied this to the strategy of containing borrowing costs. Even a small drop—just a few basis points—could save taxpayers billions.

3. Broader Lending Gains—or Risks?

Freeing up capital might encourage banks to lend more, boosting business and mortgage credit. But experts warn weaker caps could let banks take riskier positions .

4. Regulatory Trade-Offs

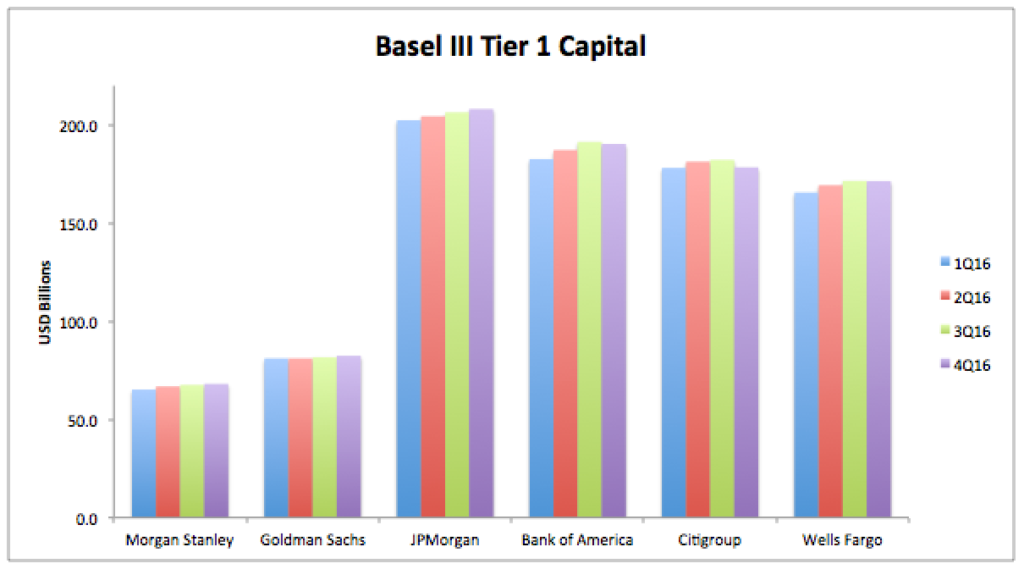

This reform coincides with the Basel III Endgame rules, which raise other capital requirements after July 1, 2025. The net effect could be modest: easing here, tightening there.

Will This Move Stick?

Timing & Politics.

The path forward involves public comment, agency coordination, and presidential politics. Even with regulatory appetite for such changes, no guarantee they’ll be finalized quickly—if at all .

Analyst Caution.

Wells Fargo and Deutsche Bank analysts say cutting the SLR might help—but not nearly as much as carving Treasuries out entirely. Plus, Moody’s warns it could be credit‑negative for large banks, adding risk to their balance sheets.

First-Person Perspective

I spent years covering post‑crisis bank reforms—and I’ve met more than one Fed insider who described the SLR as a blunt instrument, sometimes punishing even safe holdings. Easing it now could help, but only if regulators thoughtfully balance liquidity gains against systemic risks.

What You Should Watch

- June 25 Fed meeting: Watch for initial proposals and public comment timelines

- Public feedback: Regulators will open a comment period—follow trade groups like SIFMA and the Bank Policy Institute

- Markets’ reaction: Treasury yields and swap spreads (a liquidity gauge) now reflect pricing changes

- Basel III’s rollout on July 1, 2025: Could offset any benefits from SLR easing

FAQs

What is the Supplementary Leverage Ratio?

Minimum capital requirement against total assets—including Treasuries—to prevent systemic overleveraging post‑2008.

Why exclude Treasuries?

They’re low-risk and high-quality, but counted the same under SLR. Exclusion frees capital without reducing safety buffers.

When could changes happen?

After the June 25 meeting and comment period, likely in late 2025 or early 2026—if approved.

Should I expect lower mortgage or loan rates?

Only indirectly—if Treasury yields fall and banks ease pass-through pricing—but timing and impact remain uncertain.