After months of buildup and tough talks, the United States and the United Kingdom have sealed a major trade deal that slashes tariffs on cars and opens the door for zero-duty aerospace exports. But one key sector remains stuck in the negotiation mud: steel.

Despite the fanfare, a full resolution on steel has yet to be hammered out, raising big questions about what’s really holding things back—and why this old-school metal is creating new-school headaches.

US and UK Finally Reach Trade Deal

| Topic | Detail |

|---|---|

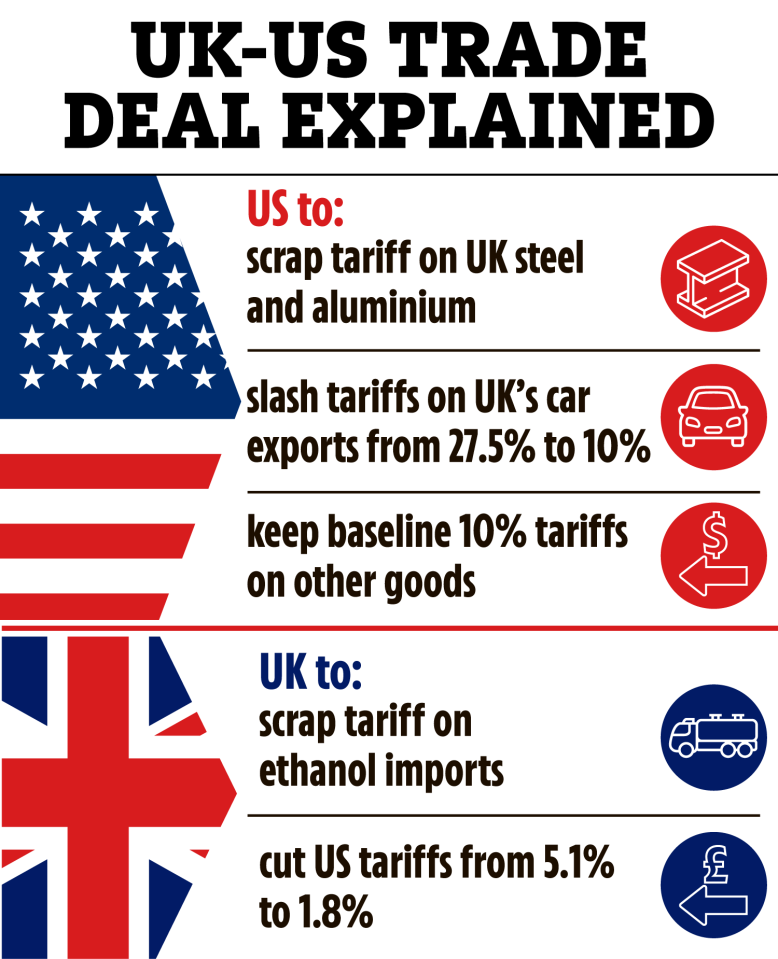

| Auto Tariffs Cut | US drops car tariffs on 100,000 UK-made vehicles, from 27.5% to 10% |

| Aerospace Duty-Free | UK secures zero-duty access for aircraft parts |

| Steel Still Stalled | 25% tariffs remain as both sides wrangle over quotas and origin rules |

The US–UK trade deal is a big milestone—but without a resolution on steel, it’s not complete. With a July deadline looming, both countries are racing to forge a final agreement. Until then, steel remains a red-hot issue in a deal that’s otherwise cooling tensions.

Automotive and Aerospace Get Green Lights

The newly signed trade deal, finalized during the G7 summit, represents the biggest economic partnership between the two countries since Brexit. The US has agreed to slash tariffs on up to 100,000 UK-built cars annually—dropping duties from a punishing 27.5% to a more manageable 10%.

It’s a major win for UK automakers like Jaguar Land Rover and Nissan, which rely heavily on US buyers. Aerospace firms also scored a victory, with new provisions that make jet engines and other high-end components eligible for zero-duty access.

UK Prime Minister Keir Starmer called the deal “a massive breakthrough,” and President Donald Trump boasted that “nobody’s been tougher or fairer on trade than us.”

But Steel’s Still Tangled in Red Tape

1. The “Melted and Poured” Sticking Point

One of the biggest hang-ups? The US insists that tariff exemptions apply only to steel that is melted and poured in the UK. That rule, designed to prevent countries like China from routing steel through third-party nations, threatens to exclude UK mills that rely on semi-finished imports.

This could be a dealbreaker for producers like Tata Steel and British Steel, which use foreign-sourced slabs in their processes.

2. Quota Instead of Full Removal

Rather than lift tariffs outright, the US is offering a quota-based system—a cap on how much UK steel can enter duty-free. The final numbers are still in flux and must be set by July 9. If no agreement is reached, tariffs could spike to 50%, more than doubling current levels.

3. Security Concerns Around Chinese Ownership

Washington is also wary of Chinese influence in UK steel. British Steel, for example, is owned by the Jingye Group, a state-linked Chinese company. US officials cite national security risks and are pushing for strict oversight on where and how quota exemptions are applied.

4. A Weak UK Steel Sector at Home

The UK’s domestic steel industry is under serious strain. High energy costs, reduced global demand, and Brexit-era instability have made things worse. The government recently passed emergency legislation—the Steel Industry (Special Measures) Act 2025)—to prop up production and prevent mass layoffs.

Expert Insight

As someone who’s reported on every major US trade dispute since the NAFTA overhaul, I can tell you this: steel always gets messy. It’s heavily politicized, slow-moving, and tangled with everything from defense policy to environmental goals. This deal has all the right headlines—but the devil is in the molten details.

What Happens Next?

- Quota Deadline: July 9

The US Commerce Department has until early July to finalize quota levels. Miss that, and the UK could face a 50% tariff hike. - Further Talks Underway

Both governments say negotiations are continuing “at pace” to resolve steel and aluminum details. But time is tight. - EU Watching Closely

Brussels is monitoring the situation. Any preferential access for the UK could trigger trade retaliation from the EU under WTO rules.

FAQs

What’s the status of UK steel tariffs?

They remain at 25%, but could rise to 50% if a quota agreement isn’t reached by July 9.

Why does the US care where steel is “melted and poured”?

This rule helps prevent foreign steel, especially from China, from entering through third-party countries like the UK.

Could British Steel be excluded from the deal?

Yes—due to Chinese ownership and reliance on imported steel, they may not qualify under the final rules.