In a striking sign of America’s growing fiscal crisis, the U.S. national debt has surged toward a staggering $37 trillion, putting former President Donald Trump’s economic legacy under intense scrutiny. As interest costs skyrocket and credit agencies wave warning flags, economists are sounding the alarm: the United States is approaching a debt reckoning.

U.S. Debt Explodes to Unthinkable $37 Trillion

| Takeaway | Stat |

|---|---|

| U.S. debt nears all-time high | $36.2 trillion (May 2025) |

| Annual interest cost | $776 billion (16% of budget) |

| Trump’s “Big Beautiful Bill” impact | +$2.4 trillion deficit over 10 years |

Trump’s economic legacy is now inseparable from America’s debt crisis. From $19 trillion in 2017 to nearly $37 trillion today, the numbers tell a story of tax cuts, unchecked spending, and political choices with massive consequences. With the nation now paying hundreds of billions in interest alone, the road ahead demands not just reform—but leadership willing to level with the American people.

A Trillion Here, A Trillion There

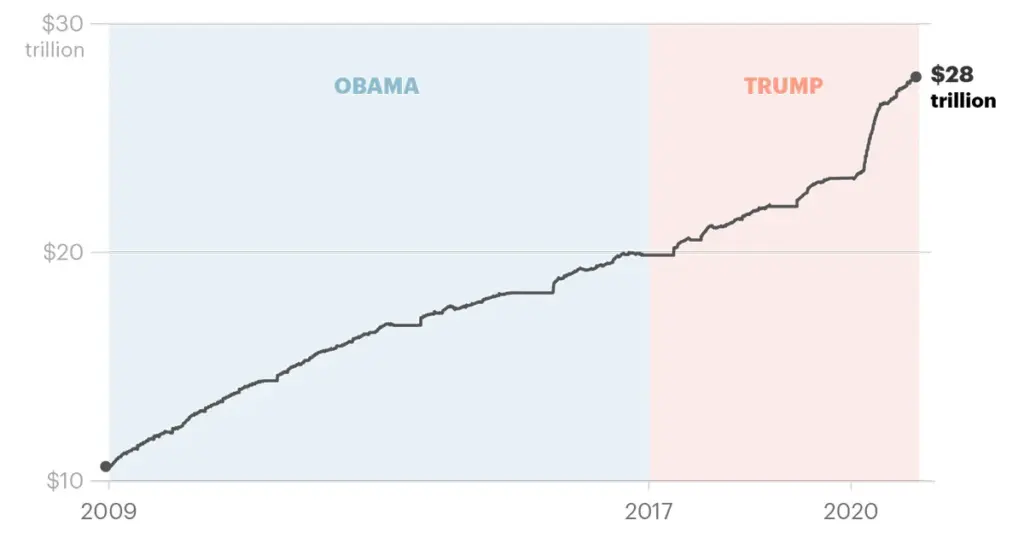

When Trump entered the White House in 2017, the national debt stood at about $19 trillion. By the time he left, it had climbed nearly 40% to $27.75 trillion—driven by sweeping tax cuts, increased spending, and later, a $5 trillion COVID-19 stimulus package.

Fast-forward to 2025, and the numbers are even more eye-popping. According to Treasury data, total U.S. debt has hit $36.2 trillion—and is projected to top $37 trillion this year. That works out to more than $106,000 per person in the U.S.

Trump’s Latest Plan: A $2.4 Trillion Booster Shot?

Despite already massive deficits, Trump’s allies in Congress are advancing what he calls the “One Big Beautiful Bill”—a broad tax-and-spending package that the Congressional Budget Office warns could add $2.4 trillion in deficits over the next decade.

Some supporters argue the bill would juice growth and simplify the tax code. But fiscal hawks and nonpartisan analysts say it worsens an already dire debt outlook. The Penn Wharton Budget Model projects the bill would push the debt-to-GDP ratio past 124% by 2034.

The Interest Time Bomb

The real danger now isn’t just the size of the debt—it’s the cost of carrying it. Annual interest payments have ballooned to $776 billion, now the second-largest line item in the federal budget after Social Security. That’s more than the U.S. spends on defense.

Moody’s slashed America’s credit rating last year, citing “unsustainable fiscal policies.” The warning? If interest costs continue climbing, the U.S. could be forced to cut critical programs—or risk further downgrades that raise borrowing costs even more.

“Trillion-dollar annual interest…threatens the dollar’s credibility,” warned Home Depot co-founder Ken Langone in a recent interview with The Sun.

Renowned economic historian Niall Ferguson told Business Insider that the U.S. is already entering the late stage of financial dominance erosion. “The moment interest payments exceed defense spending, the power dynamics shift,” he said.

The Middle-Class Squeeze

Beyond Wall Street, these deficits have real-world effects. The proposed Trump bill includes cuts to Medicaid, SNAP, and housing assistance—programs that millions rely on. Analysis from Yale’s Budget Lab shows most benefits of the tax reform would flow to the top 20% of earners, while middle- and low-income families face reduced support.

“We are living beyond our means—and passing the bill to our kids,” said Maya MacGuineas, president of the Committee for a Responsible Federal Budget.

Can We Pull Back from the Brink?

Economists agree that avoiding a full-blown crisis will require painful but necessary reforms:

- Capping entitlement growth, especially in Social Security and Medicare

- Reforming the tax code to close corporate loopholes and restore higher top-bracket rates

- Reintroducing fiscal guardrails, like the 2011 Budget Control Act (which expired in 2021)

A bipartisan fix remains elusive, especially in an election year. But without serious action, the next president—Trump or not—will inherit a fiscal time bomb.