The United States’ trade policy has been under the spotlight since former President Donald Trump implemented his controversial tariff strategy, which sought to reshape trade relations and protect American industries. Fast forward to 2025, and Trump’s tariff policies continue to have lasting effects. As the month of June unfolds, there is growing speculation that the impact of these policies could drive the country to set a new record for tariff revenue.

Trump’s Tariff Strategy Could Set a New Monthly Record This June

| Takeaway | Stat/Fact |

|---|---|

| Trump’s tariffs persist | Trump’s tariffs on China alone contributed $79 billion to the Treasury in 2020. |

| Potential record high | June 2025 could see record-breaking tariff income, surpassing $10 billion for the month. |

| Ongoing effects on U.S.-China trade | Trump’s tariffs remain in place for many Chinese goods, continuing to impact trade flows. |

June 2025 could go down in history as a record-setting month for U.S. tariff revenue, a testament to the enduring legacy of Trump’s tariff policies. While the tariff strategy was controversial during his presidency, its financial impact is undeniable, with the U.S. set to surpass $10 billion in monthly tariff collections. The question remains whether this strategy will continue to benefit the U.S. Treasury in the long term or whether it will ultimately prove too costly for American consumers and industries.

The Legacy of Trump’s Tariff Strategy

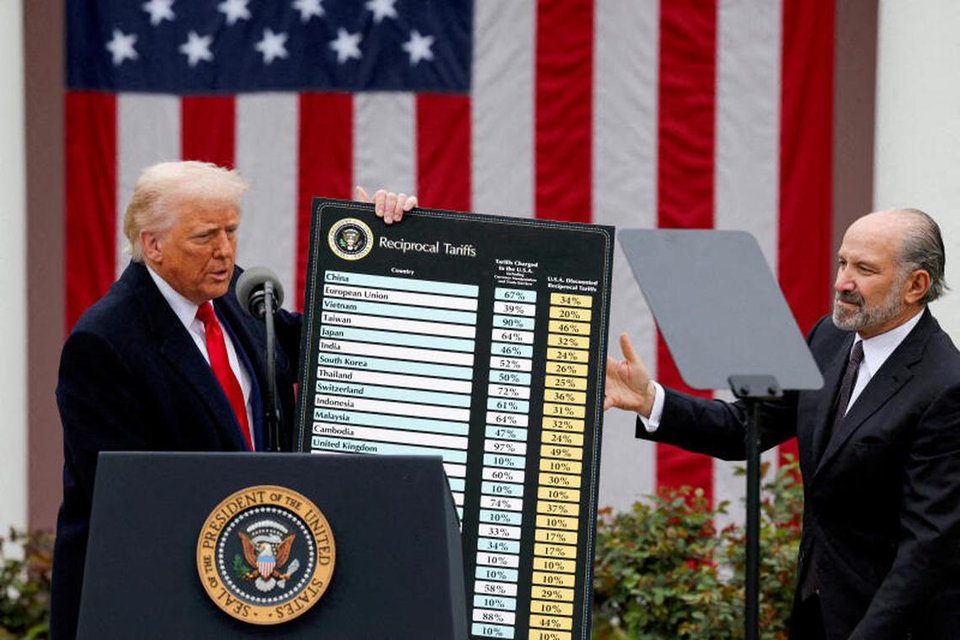

When President Trump launched his tariff campaign against China in 2018, it was framed as a battle to protect American workers, counter unfair trade practices, and restore balance to trade deficits. The U.S. imposed tariffs on hundreds of billions of dollars’ worth of Chinese goods, and China retaliated with its own tariffs on American exports. The result? A trade war that left a lasting imprint on both economies.

At its peak, the U.S. implemented tariffs ranging from 10% to 25% on Chinese goods. While some of these tariffs have been reduced or replaced through new trade deals, many remain in place, especially on goods like electronics, machinery, and textiles. According to the U.S. Census Bureau, tariffs collected from imports were a significant revenue stream, with the U.S. earning nearly $79 billion in tariffs in 2020 alone from goods primarily affected by the Trump-era policies.

While President Biden has altered some aspects of trade policy, including lifting certain tariffs and negotiating new agreements, many of Trump’s tariffs are still in play, particularly against China. This enduring legacy is a major reason why June 2025 could be on track to set a new monthly record for tariff revenue.

The Tariff Revenue Surge in 2025

As we move into the second quarter of 2025, there are key factors driving tariff revenue upward. First, import volumes remain robust. The U.S. economy has continued its recovery, leading to increased consumer demand, which in turn boosts imports. Since the tariffs remain in place for a large portion of Chinese imports, these products are subject to additional costs when they arrive in U.S. ports. For example, electronics, furniture, and even clothing items may see price increases due to these tariffs. The added costs of these imports flow directly into the U.S. Treasury.

In addition, global inflation has remained a driving force behind higher prices across the board, including the import sector. As the costs of goods increase worldwide, the duties imposed on these goods also rise. This creates a scenario where tariff revenue, which is already substantial, continues to climb.

Why June Could Break the Record

The forecast for June 2025 is particularly optimistic for two reasons. First, the summer months traditionally see a spike in imports, as businesses ramp up for the back-to-school and holiday seasons. This seasonal increase could result in more goods crossing U.S. borders, bringing in higher tariff revenues. Second, recent reports indicate that China has been increasing its exports to the U.S. following post-pandemic recovery, and the tariffs imposed during Trump’s administration are still applying pressure on these imports.

Economic experts predict that June 2025 could see more than $10 billion in tariffs collected in a single month, which would be a record for monthly revenue since the tariffs were first enacted.

The Long-Term Impact of Tariffs

While the record-breaking revenue is a positive for the U.S. Treasury, there are mixed opinions about the long-term effectiveness and impact of Trump’s tariff strategy. Critics argue that tariffs are essentially a tax on consumers, as businesses often pass on the additional costs of imported goods to the public. This can result in higher prices for everyday items, particularly for working-class families who depend on affordable imports. For example, American households may see the cost of everything from appliances to clothing increase as a result of these tariffs.

Economists also warn that the global trade landscape has shifted in response to these policies. While tariffs have helped some domestic industries, especially those in manufacturing and steel production, they have also strained relations with key trade partners. The retaliatory tariffs imposed by countries like China and the European Union have impacted American farmers and manufacturers who depend on exports to these markets.

On the other hand, proponents of the tariff strategy argue that the long-term benefits of protecting American industries and jobs are worth the temporary economic strain. The tariffs were intended to bring jobs back to the U.S. and to curb what Trump described as unfair trade practices by countries like China. Whether or not those goals have been fully achieved remains a point of contention, but the revenue generated by tariffs is undeniably a significant factor in the U.S. economy.

What’s Next for U.S. Tariffs?

As June 2025 looms large, many are wondering what the future holds for U.S. tariffs. President Biden’s administration has shown signs of shifting away from the confrontational trade policies of the Trump era, but significant changes have yet to be made. The U.S. and China continue to hold complex negotiations, and Biden’s tariff policy still echoes the previous administration’s stance to some degree, particularly when it comes to China.

However, as the June tariff record draws near, it’s clear that Trump’s strategy is still having a profound influence on the U.S. economy. While the short-term revenue benefits are evident, the long-term effects of these tariffs will depend on future trade negotiations, global market trends, and how the Biden administration chooses to approach U.S. trade policy going forward.

FAQs

Why are Trump’s tariffs still in place?

Trump’s tariffs are still in place because the Biden administration has kept many of the policies in effect, particularly those targeting China. The focus remains on addressing trade imbalances and protecting U.S. industries, despite the ongoing global debate about their effectiveness.

How do tariffs impact American consumers?

Tariffs increase the cost of imported goods, which is typically passed on to consumers. This can lead to higher prices for items like electronics, clothing, and household goods.

What industries benefit most from tariffs?

Industries such as steel, manufacturing, and domestic agriculture have benefited from the protectionist policies of Trump’s tariff strategy. These industries have seen a reduction in competition from imported goods, leading to increased demand for U.S.-made products.