In a surprise move that’s making waves across the political spectrum, Donald Trump has unveiled a bold new proposal: a $1,000 investment account for every baby born in the United States starting in 2025. Dubbed “Trump Accounts,” the plan is drawing praise, skepticism, and a whole lot of questions about what’s really at stake.

Trump Shocks Nation With $1,000 ‘Trump Accounts’ for Every Newborn

| Insight | Stat or Fact |

|---|---|

| Each newborn gets a $1,000 account | Starting Jan 1, 2025 |

| Contributions grow tax-free | In a low-cost index fund |

| Could add $2.4 trillion to national debt | Over 10 years |

| Major welfare cuts tied to proposal | Includes Medicaid and food aid |

Trump’s $1,000 “Trump Accounts” proposal is one part economic experiment, one part political theater. It could help millions of American kids build savings early—but only if families and lawmakers are willing to grapple with the bigger costs. If it passes the Senate, it might reshape how America thinks about family policy for a generation. Or it might just be the boldest campaign ad of 2025.

What Exactly Are ‘Trump Accounts’?

Trump Accounts are tax-deferred investment accounts that would be automatically opened for every baby born in the U.S. from January 1, 2025, through at least 2028. Each account starts with a $1,000 deposit, and families—or even employers—can add up to $5,000 annually. These funds are parked in low-cost index funds and grow tax-free until withdrawal.

It’s sort of like a 529 plan, but with a splash of MAGA branding—and less red tape.

“We’re creating a future where every child is born with a stake in the American Dream,” Trump told a packed rally in Phoenix last week.

As a dad who opened a 529 for my own daughter shortly after she was born, I know how daunting that first step toward saving can feel. If this plan pans out, it could make that process automatic—and give families a leg up from day one.

How Would the Money Be Used?

Starting at age 18, beneficiaries can begin tapping their Trump Account funds for specific uses like:

- College tuition or vocational training

- Starting a small business

- Buying a first home

Withdrawals for these “qualified purposes” are taxed at favorable long-term capital gains rates. Non-qualified uses? Those get hit with regular income tax and possibly a penalty, though the exact details are still fuzzy.

And if the money isn’t used by age 30? That’s when full withdrawals kick in—with fewer strings attached.

So What’s the Catch?

Like many things in politics, the devil’s in the details.

1. Not Income-Targeted

Unlike some Democratic-backed “baby bonds” that focus on low-income families, Trump Accounts are universal. That means kids born to millionaires and minimum wage workers alike get the same $1,000 seed. Critics argue that this may actually widen the wealth gap, not narrow it.

2. Big-Time Budget Tradeoffs

Here’s where it gets thorny. The Trump Accounts are part of a larger package nicknamed the “One Big Beautiful Bill,” which includes deep cuts to Medicaid, SNAP, and other safety nets. According to the Congressional Budget Office, these cuts could affect up to 10.9 million Americans.

3. Modest Growth, Modest Impact

Even with a healthy 7% annual return, $1,000 invested at birth only grows to about $3,570 by age 18. That’s helpful—but not life-changing—unless parents or others contribute significantly more each year.

4. $2.4 Trillion Price Tag

The CBO estimates the Trump Account initiative would cost the federal government about $3 billion a year, contributing to a projected $2.4 trillion increase in the national debt over a decade.

Corporate America Is on Board

Surprisingly, the Trump Accounts are getting support from some corporate heavyweights. CEOs from companies like Goldman Sachs, Dell, Uber, and Salesforce have pledged to offer matching contributions for employees’ children. Whether it’s PR or genuine support, the private sector’s involvement could help take the idea mainstream.

Political Showdown Ahead

The Trump Accounts plan has already passed the House, bundled into the broader GOP budget package. But it faces a tougher road in the Senate, where moderate Republicans and all Democrats have voiced concerns over its tradeoffs. Whether the bill survives—and in what form—will likely come down to backroom negotiations this summer.

Is This Really New?

Not entirely. The concept echoes ideas from both sides of the aisle, including Sen. Cory Booker’s “baby bonds” and proposals from the American Enterprise Institute. What makes Trump’s plan different is its universal rollout and branding.

Let’s be real: calling them Trump Accounts isn’t just a policy choice—it’s a branding play.

FAQs

What happens if the child dies before age 18?

Funds would be transferred to the family’s estate or a designated sibling, though details remain under discussion.

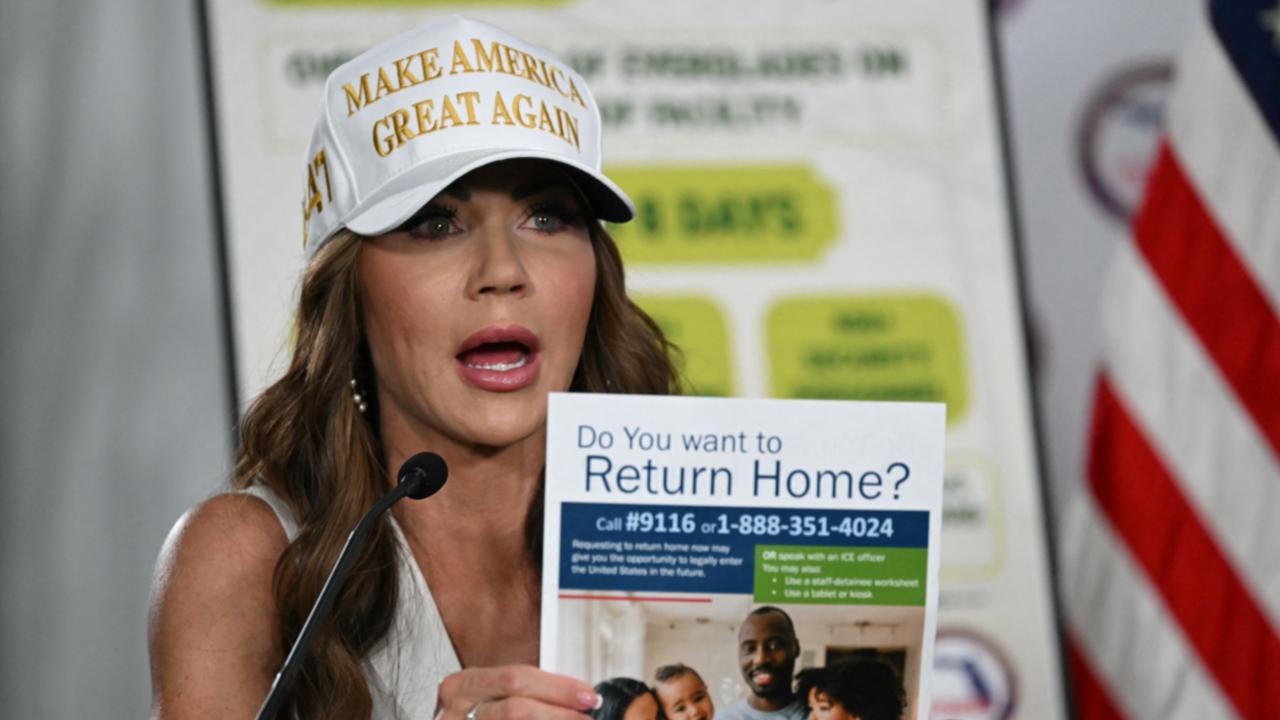

Can undocumented children qualify?

Only children born to legal residents and U.S. citizens qualify under the current proposal.

Will the money affect college financial aid?

Possibly. Like 529s, these accounts could count toward assets on the FAFSA unless new exemptions are added.