In a surprise move, former President Donald Trump has delayed the implementation of a 50% tariff on steel and aluminum imports from the United Kingdom. The announcement has caused a ripple of uncertainty in the international trade market, especially as the UK grapples with the potential impact of these tariffs on its manufacturing and trade relations. But what does this mean for both countries moving forward? And what could be the economic consequences of such a delay?

Trump Delays 50% Metal Tariffs on UK

| Takeaway | Stat/Fact |

|---|---|

| Tariff Delay Impact | The UK’s steel and aluminum exports to the U.S. are worth around $500 million annually. |

| Trade Talks Resumed | The U.S. and UK have resumed trade negotiations in an effort to strike a new deal. |

| Economic Ripple Effect | The U.S. tariff could lead to job losses in the UK manufacturing sector if implemented. |

While the delay of the 50% tariffs on UK steel and aluminum may be seen as a temporary relief, the future of U.S.-UK trade relations remains uncertain. As both countries continue to negotiate trade deals, there is still a real possibility that these tariffs could be reinstated or even increased in the future. For now, UK manufacturers can breathe easier, but they remain wary of what’s to come.

In the long term, this tariff delay might be a small piece of a much bigger puzzle in international trade, with far-reaching consequences that go beyond just the UK and the U.S. As the global economy continues to evolve, the full implications of this delay will become clearer in the months and years ahead.

Trump’s Tariff Decision: A Diplomatic Move or Strategic Delay?

Former President Trump’s decision to delay the 50% tariff on UK metal imports isn’t a sudden change of heart—it’s more about strategic timing. The delay could serve multiple purposes, including gaining leverage in trade negotiations or buying time for political reasons. It’s important to note that the tariffs, which were first proposed in 2023, were met with backlash from the UK and EU, along with a host of other trade partners. These tariffs were initially meant to protect U.S. manufacturing by making imported steel and aluminum more expensive, but the ripple effects on global trade were undeniable.

According to experts, this delay may not signal a complete end to the tariffs but rather a way for the U.S. to reassess its long-term trade strategy. It’s also possible that the delay is a sign that Trump, or the current U.S. administration, is seeking to strike a more favorable deal with the UK, especially as post-Brexit trade relationships evolve.

Economic Ramifications for the UK: A Delayed Blow?

The steel and aluminum industries in the UK have been on high alert since the tariff talks first emerged. UK officials have estimated that the tariffs could cost the country’s metal export sector upwards of $500 million annually. While the delay is a temporary relief, many are wondering how long this reprieve will last.

The tariffs were expected to lead to price hikes for U.S. consumers, especially in industries that rely on steel and aluminum—such as automotive manufacturing, construction, and aerospace. For the UK, which has spent years recovering from the economic fallout of Brexit, the threat of tariffs hanging over its head is a major concern. The country had hoped that a closer trade relationship with the U.S. would help offset some of the challenges caused by its departure from the European Union, but the tariff dispute has complicated matters.

With this delay, UK manufacturers can breathe a temporary sigh of relief. However, they’re left in limbo, unsure of what comes next in the U.S.-UK trade relationship.

The U.S. Perspective: Protecting American Jobs or Playing Hardball?

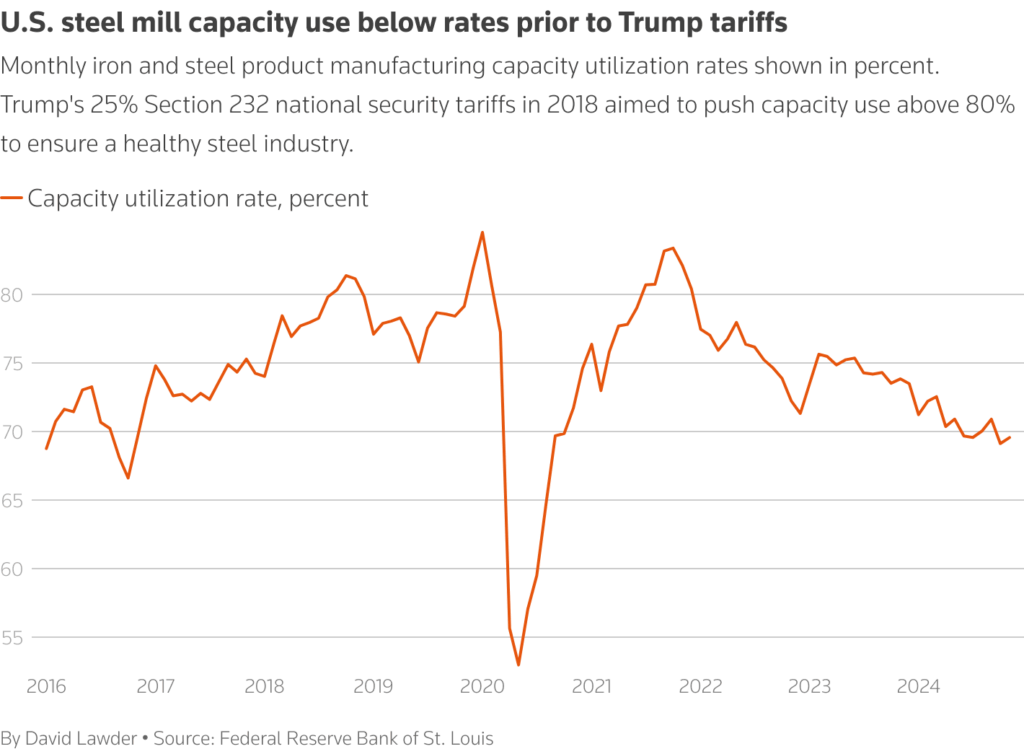

From the U.S. perspective, tariffs on imported metals like steel and aluminum were initially introduced to protect domestic industries from foreign competition. The idea was to make it more expensive for foreign producers to sell their metals in the U.S., thus giving American manufacturers an advantage.

Trump’s administration, which pushed for these tariffs, argued that they were vital for national security and economic stability. However, these moves have been met with mixed reactions. On the one hand, some sectors have benefited from increased protection. On the other hand, industries that depend on imported metals have faced higher costs, which they argue hurt American workers and consumers in the long run.

The 50% tariff on UK metal imports was seen as an extension of this protectionist strategy, with the aim of keeping U.S. industries competitive. However, as global economies continue to shift, there may be growing pressure on the U.S. to rethink these strategies and consider the broader economic impact, particularly as relations with key allies like the UK become more critical.

A Resumption of Trade Talks: A Path Toward Resolution?

With the tariff delay in place, it’s clear that both the U.S. and the UK have more to discuss. The U.S. and the UK have resumed trade negotiations, with both sides working to reach a new deal that could eliminate tariffs on certain goods, including metals. These discussions are seen as an opportunity to reset the economic relationship between the two countries, especially as the UK looks to expand its global trade network post-Brexit.

The U.S. is also facing internal pressures to renegotiate trade deals with its allies. Many argue that high tariffs on key partners could ultimately harm U.S. consumers and businesses. Furthermore, the ongoing tensions with China and other economic powerhouses have led to a rethinking of trade priorities in Washington. As such, the delayed tariffs on UK metal imports may just be a temporary pause in what could become a longer series of trade discussions between the two countries.

What’s Next for Global Trade?

While the specific delay of the 50% tariffs on UK steel and aluminum imports is a localized issue, it could have ripple effects on global trade. The delay could signal a shift in how the U.S. approaches trade agreements, especially as the Biden administration (and potentially future administrations) continue to navigate the complexities of a post-pandemic global economy.

There’s also the bigger question of how these tariffs may affect other countries. If the U.S. decides to ease tariffs on UK metals, this could open the door for similar negotiations with other trade partners. The long-term effect could be a restructuring of international trade agreements, where the U.S. aims for more nuanced and strategic deals rather than broad tariffs.

The Political Angle: Domestic and International Implications

Domestically, the delay in implementing these tariffs could have significant political implications. The debate over trade policy continues to be a hot-button issue in U.S. politics. While many Americans support policies that protect domestic industries, others argue that these tariffs increase prices for consumers and hurt the global economy.

On the international stage, the delay might be interpreted as a sign that the U.S. is willing to take a more diplomatic approach with its allies. Trade tensions with the UK had been on the rise, and this move could help ease some of that strain, paving the way for more cooperation between the two countries.

FAQs

Q: Why are the U.S. tariffs on UK metals being delayed?

A: The delay may be a strategic move to give both sides time to negotiate a new trade deal. It could also be a way for the U.S. to gain leverage in future talks.

Q: How much is the UK expected to lose if the tariffs are implemented?

A: The UK could lose around $500 million annually in steel and aluminum exports to the U.S. if the tariffs are fully imposed.

Q: Will the tariff delay affect global trade?

A: Yes, the delay could have ripple effects, particularly in how the U.S. approaches future trade deals with other countries.