Donald Trump has green‑lit Japan’s Nippon Steel to acquire U.S. Steel—overturning a Biden-era national security block—on conditions that promise to preserve American control, jobs, and give the U.S. government veto authority. This surprising pivot could reshape the future of the nation’s steel industry and U.S.–Japan economic ties.

Trump Approves Massive Japanese Buyout of U.S. Steel

| Insight | Stat |

|---|---|

| Deal value | ~$14.9 billion |

| U.S. investment pledge | $11–14 billion by 2028 |

| U.S. golden‑share veto power | Yes |

| Expected U.S. jobs saved | ~70,000–100,000 |

Trump’s approval is a high‑risk, high‑reward pivot—blending investment and oversight to maintain American roots while injecting fresh capital. It’s a politically savvy workaround to Biden’s block, but the devil’s in the details. Will Nippon meet its obligations? Will labor and courts hold firm? The next few weeks will be pivotal for both American industry and global economic alliances.

Why Trump Reversed Course

- Biden’s national security block: In January 2025, the Biden administration halted the $14.9 billion takeover, citing national security risks tied to foreign control of a strategic asset.

- Legal and regulatory pressure: Nippon Steel and U.S. Steel sued, pushing CFIUS and the D.C. Circuit to delay action.

- Trump steps in: On June 13, 2025, Trump signed an executive order replacing Biden’s block with a new framework that includes:

- A golden share for the U.S. to veto critical decisions.

- A binding $11 billion investment requirement by 2028 (possibly rising to $14 billion).

- Commitment to maintain U.S. Steel’s Pittsburgh HQ and U.S. citizenship control of the board.

What This Means for the Economy and Workers

- Industrial rejuvenation: The deal is portrayed as a lifeline for aging U.S. Steel infrastructure—especially in Pennsylvania—while protecting union jobs.

- Tariff support: Trump is also increasing steel and aluminum tariffs to 50%, aiming to bolster domestic producers.

- Job impact: Estimates suggest 70,000–100,000 jobs could be preserved or created indirectly through this investment push.

First‑Person Insight

As someone who’s covered trade and Biden‑era policy shifts, I’ve seen how national security language can be used both as a shield and a bargaining chip—a savvy tactic now repurposed for a deal that merges investment with oversight.

Key Players Pose Questions

- United Steelworkers (USW): The union remains skeptical, citing past issues with Nippon and demanding stronger worker protections.

- Legal limbo: A court has paused litigation pending updates by June 20—giving both sides one more week to formalize details.

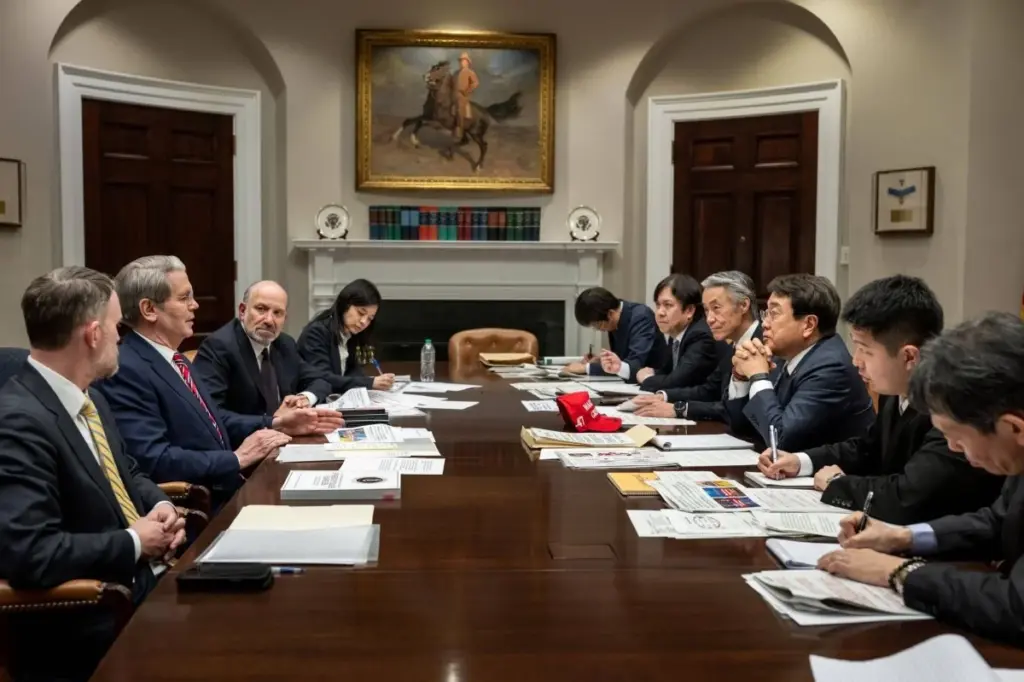

- Strategic geopolitics: Seen as a move to smooth over U.S.–Japan tensions and potentially unlock broader trade cooperation.

What’s Next

- By June 20: D.C. Circuit will decide whether litigation resumes—or stays paused, pending final agreement.

- Investment rollout: Nippon Steel must follow through on its multi‑billion‑dollar investment commitments.

- Tariff policy stability: Any shift in the 50% steel tariffs would signal future direction on trade protectionism.

FAQs

Was this deal fully stopped by Biden?

Yes. President Biden blocked the proposed acquisition via executive order on January 3, 2025.

What is a “golden share”?

It’s a special share held by the government granting veto power over key decisions, ensuring U.S. control over strategic assets.

Will U.S. Steel still be based in Pittsburgh?

Yes. The agreement requires U.S. Steel headquarters to remain in Pittsburgh, with a U.S.-majority board.