Americans are getting an unexpected cash bonus—up to $1,000 through new stimulus-style programs. But here’s the catch: it’s not coming from Congress this time. Instead, several states and local governments, plus the IRS, are quietly rolling out financial relief programs targeted at specific groups.

If you’re a senior, parent, low-income resident, or someone who missed out on a previous stimulus, this guide breaks it all down—who qualifies, how much you’ll get, and how to claim it.

Surprise! Another $1,000 Stimulus Hitting Bank Accounts

| Details | Information |

|---|---|

| Maximum Amount Offered | Up to $1,000 per month or one-time $1,000 payment |

| Who Is Eligible? | Seniors, people with disabilities, pregnant women, low-income families, and tax filers who missed the 2021 Recovery Rebate |

| Where Are Payments Available? | California, Pennsylvania, Mississippi, Los Angeles County, and nationwide via IRS |

| Deadline to Apply | Varies by program. Some close by December 31, 2025 |

| How to Apply | Through official government websites or IRS filings (links provided below) |

| Official Sources | irs.gov, revenue.pa.gov |

In a world where inflation is hitting harder than ever, these surprise $1,000 payments are a welcome relief for thousands of Americans. Whether you’re a pregnant mom in California, a senior in Pennsylvania, or someone who simply forgot to file for a past stimulus check, help is out there—you just have to know where to look. Don’t miss out. These programs aren’t just headlines—they’re real money landing in real bank accounts.

What Is This New $1,000 Stimulus Payment?

The recent announcements regarding new $1,000 stimulus payments have garnered significant attention. However, it’s essential to understand that these payments are not part of a new federal stimulus program but are instead specific initiatives targeted at certain groups or regions.

IRS Recovery Rebate Credit

The Internal Revenue Service (IRS) has identified approximately 1 million taxpayers who did not claim the Recovery Rebate Credit on their 2021 tax returns. As a result, the IRS is automatically issuing payments of up to $1,400 to these individuals. No action is required for those who have already filed their 2021 tax returns; however, taxpayers who have not yet filed have until April 15, 2025, to do so and claim the credit.

Programs Currently Offering $1,000 Stimulus Payments

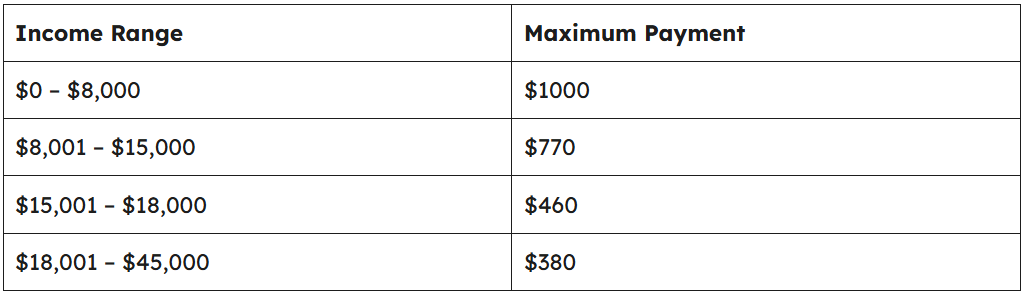

Pennsylvania Property Tax and Rent Rebate Program

Who Qualifies:

- Seniors 65 and older

- Widows and widowers 50 and older

- People with disabilities 18 and older

Payment Details:

You can receive a maximum rebate of $1,000. Additional supplements of up to $500 are available for low-income homeowners who pay more than 15% of their income in property taxes. This rebate is ideal for seniors or disabled residents facing rising property taxes or rent.

California’s Abundant Birth Project

Who Qualifies:

- Pregnant women between 8–27 weeks

- Residents of Alameda, Contra Costa, Los Angeles, or Riverside counties

- Must meet income limits and health risk criteria

- Cannot be enrolled in another guaranteed income program

Payment Details:

Participants receive $1,000 a month during pregnancy, paid on a reloadable debit card.

Enrollment: Enrollment opens in cycles. Monitor updates regularly.

This program is aimed at improving maternal health outcomes for high-risk pregnancies.

Los Angeles County’s Breathe Program

Who Qualifies:

- Adults 18+ living in LA County

- Low-income households

- Must show financial hardship due to COVID-19

Payment Details:

Selected individuals receive $1,000 per month, with current participants enrolled through August 2025.

This program serves as a guaranteed income pilot, showing how regular, unconditional cash can improve financial stability.

Mississippi’s Magnolia Mother’s Trust

Who Qualifies:

- Low-income Black mothers living in Jackson, Mississippi

Payment Details:

Participants receive $1,000 per month for 12 months, along with mental health support, job coaching, and $1,000 in a child’s education savings account.

This is the longest-running guaranteed income program in the U.S., proving how targeted help changes lives.

IRS Recovery Rebate Credit: Up to $1,400 for Late Filers

Who Qualifies:

- Taxpayers who missed the third COVID-era stimulus in 2021

- Must file a 2021 tax return

Payment Details:

The IRS is sending out up to $1,400 per person automatically to over 1 million Americans who didn’t claim the credit. This may be the easiest stimulus to get—just file that tax return.

Eligibility Recap: Who Should Pay Attention

Income and Status-Based Criteria

- Income below $35,000 (typically)

- Pregnant and living in eligible CA counties

- Low-income senior renters/homeowners in Pennsylvania

- Low-income single Black mothers in Jackson, MS

Geographic Requirements

- Breathe Program: Los Angeles County, CA

- Abundant Birth: Select CA counties

- Property/Rent Rebate: Pennsylvania residents only

- Magnolia Mother’s Trust: Jackson, Mississippi

IRS Rebate

- Nationwide, if you were eligible for stimulus in 2021 but didn’t receive it

- Must file your 2021 return

How to Apply or Check Payment Status

State Programs

- Pennsylvania Residents: Visit revenue.pa.gov

- California Residents: Monitor the Abundant Birth Project

- Los Angeles County: See breathe.lacounty.gov

- Mississippi Residents: Learn more via Magnolia Mother’s Trust

What If I Miss the Deadline or Am Not Eligible Now?

Even if enrollment is closed or you don’t qualify today, here’s what you can do:

- Sign up for email alerts on program pages

- Bookmark application pages and check back monthly

- File your taxes, especially for missed stimulus credits

- Join community aid groups in your area that track benefit deadlines

Being proactive is your best bet. These programs don’t always get massive headlines, so the people who stay informed are the ones who benefit.

Why These Programs Matter

These local and state initiatives are doing what federal relief can’t right now—providing immediate, targeted help. They’re also part of broader conversations around universal basic income (UBI) and guaranteed support for vulnerable populations.

Programs like Magnolia Mother’s Trust and Breathe are data-driven, with results showing improved mental health, job stability, and reduced stress for participants.

Tips, Myths, or Mistakes Section

Navigating a Potential Stimulus: Tips & Common Myths

- DO: Keep your direct deposit information updated with the relevant government agencies (like the IRS in the U.S.) for the fastest payment.

- DON’T: Fall for scams! The government will never call, text, or email you asking for personal information or payment to “release” your stimulus funds.

- MYTH: “Everyone automatically gets it.” REALITY: Stimulus payments often have income thresholds and other eligibility requirements. It’s not a universal handout.

- TIP: Stay informed by checking official government websites directly, not just social media rumors.

Frequently Asked Questions (FAQs)

Are these payments taxable?

Generally, no. Most guaranteed income pilots treat the funds as non-taxable. However, the IRS rebate is a tax credit, which reduces your tax liability but isn’t considered taxable income.

Can I receive more than one program benefit?

It depends. Some programs restrict participation if you’re already in another guaranteed income pilot. Always read the eligibility fine print.

What if I missed the application window?

Don’t give up. Programs reopen with new funding rounds. Keep checking their official pages and sign up for updates.

Do these programs require citizenship?

Not always. Many state programs are open to residents regardless of immigration status, but IRS stimulus payments do require a Social Security number.

Will there be another federal stimulus?

As of now, no new federal stimulus is planned. These state and local efforts are filling the gap.