If you’re counting on a cost-of-living adjustment (COLA) to boost your Social Security benefits in 2026, brace yourself. Recent tariff hikes are stirring economic waters, potentially impacting your wallet. Here’s what you need to know about how these changes could affect your benefits.

Social Security COLA 2026 at Risk?

| Takeaway | Stat |

|---|---|

| Projected 2026 COLA | 2.4% |

| Tariffs’ Impact on Inflation (2025-2026) | +0.4 percentage points annually |

| Potential GDP Reduction Due to Tariffs | 6% |

The intersection of rising tariffs and Social Security benefits is complex and evolving. While the intent behind tariffs is to strengthen the economy, the immediate effects may pose challenges for retirees relying on Social Security. Staying proactive and informed is your best strategy to navigate these uncertain times.

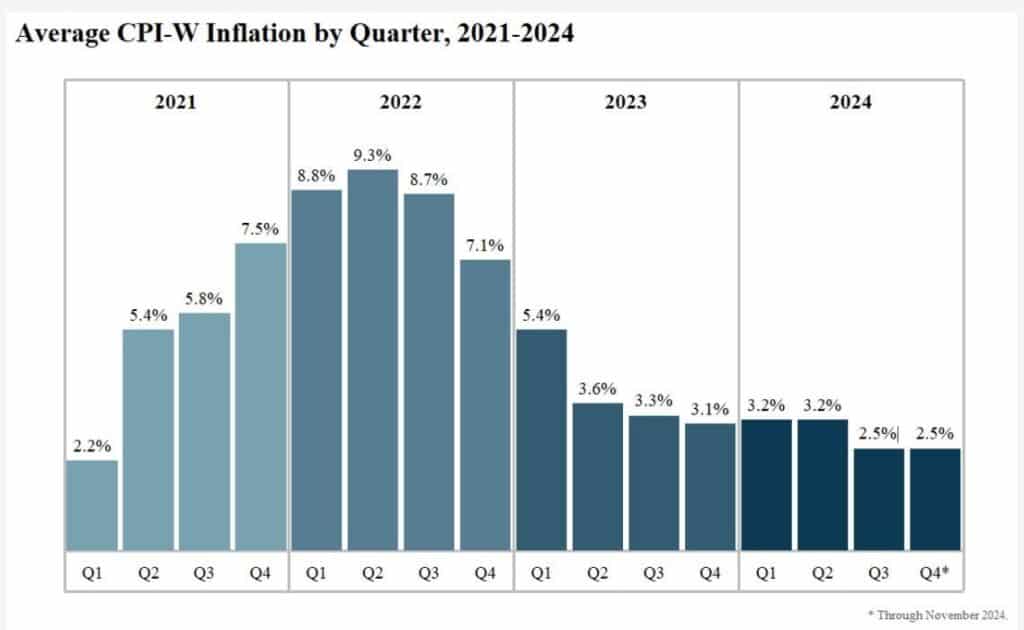

Understanding the 2026 COLA Forecast

The Social Security Administration (SSA) calculates the COLA based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). As of April 2025, projections estimate a 2.4% increase for 2026, marking the lowest adjustment since 2021. This modest rise follows higher adjustments in previous years, such as 5.9% in 2022 and 8.7% in 2023, driven by pandemic-related inflation.

Tariffs and Their Economic Ripple Effects

President Trump’s recent tariff implementations, including a 10% baseline on most imports and up to 145% on Chinese goods, aim to reduce the federal deficit by $2.8 trillion over the next decade. However, these tariffs are expected to increase inflation by 0.4 percentage points annually in 2025 and 2026, according to the Congressional Budget Office. Moreover, the Penn Wharton Budget Model projects a 6% reduction in GDP and a 5% drop in wages due to these trade policies.

The Double-Edged Sword: Inflation and COLA

While higher inflation typically leads to a higher COLA, the current economic scenario presents a paradox. The tariffs are anticipated to raise prices on essential goods, including food and medical supplies, which disproportionately affect seniors. However, the COLA may not adequately compensate for these increased living costs, potentially eroding the purchasing power of Social Security benefits.

Potential Strain on the Social Security Trust Fund

Beyond individual benefits, the broader economic slowdown induced by tariffs could strain the Social Security Trust Fund. Reduced economic growth may lead to lower employment and, consequently, decreased payroll tax revenues, which fund Social Security. This scenario could accelerate the depletion of the trust fund, currently projected for 2034.

What This Means for You

As a retiree or soon-to-be retiree, it’s crucial to stay informed about these developments. Consider consulting with a financial advisor to assess how potential changes in COLA and the broader economy might impact your retirement plans. Diversifying income sources and adjusting your budget to account for possible increases in living expenses can also provide a buffer against economic uncertainties.