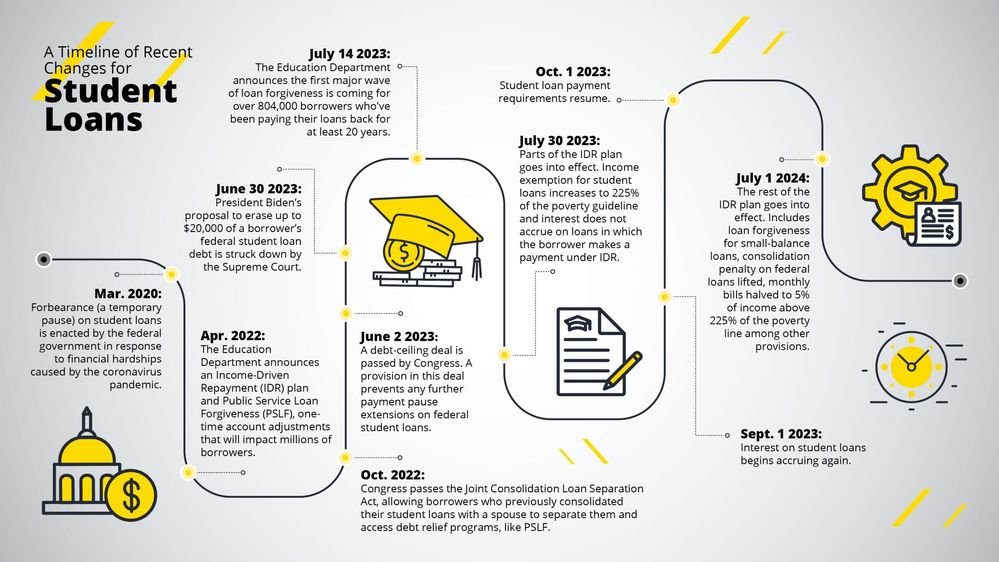

With sweeping student loan reforms just approved by the U.S. Senate, millions of borrowers—from grad students to parents—are facing a brand-new repayment reality. If you’ve got student loans or plan to borrow, here’s what you need to know and why it matters.

Massive Shake-Up in Student Loans

| Change | What It Means |

|---|---|

| Only 2 income-driven repayment plans remain | SAVE, PAYE, ICR, REPAYE will be sunset |

| Forgiveness timeline pushed to 30 years | Longer repayment, more total interest |

| Grad and Parent PLUS loans capped | Lower borrowing limits starting 2026 |

| Deferments removed for hardship/unemployment | Payments required regardless of income status |

This Senate-approved student loan bill is the most significant shake-up we’ve seen in decades. It simplifies repayment plans and reins in federal loan access—but also risks making college less accessible for low-income families and grads. The final decision now hinges on House negotiations. Whether you’re a student, borrower, or parent, it’s time to rethink your education financing playbook.

A Major Overhaul of Repayment Plans

The Senate’s student loan reform bill, spearheaded by Sen. Bill Cassidy (R-LA), consolidates the current four income-driven repayment plans into just two: a standard plan and a new Repayment Assistance Plan (RAP).

Under RAP, borrowers would pay 1–10% of their adjusted gross income, including their spouse’s income, with a $10 minimum payment. If that monthly amount doesn’t cover the interest, the unpaid portion gets forgiven. Full loan forgiveness kicks in after 30 years—10 years longer than some current plans.

Here’s the kicker: For many borrowers enrolled in Biden’s SAVE plan, this means not only higher payments, but also waiting longer for forgiveness. As someone who spent years navigating repayment under REPAYE, I can say: stretching it to 30 years with stricter caps feels like a backslide for low-income grads.

“Making student debt much harder to repay… could unleash an avalanche of student loan defaults,” said Sameer Gadkaree of the Institute for College Access & Success.

Grad and Parent PLUS Loans: The New Limits

Starting July 1, 2026, borrowing caps will hit graduate and professional students hard:

- Graduate students: $20,500/year for most programs

- Professional students: $50,000/year (medicine, law, etc.)

- Lifetime caps: $100,000 for master’s; $200,000 for professional degrees

Parent PLUS loans—previously uncapped—are also getting trimmed:

- $20,000/year per child

- $65,000 lifetime cap per child

These caps are designed to control federal spending, but they may push more students and families toward private loans, which often carry higher interest rates and fewer protections.

“This bill is an improvement from the House’s version… but access for low-income students will be reduced,” warned the American Council on Education.

No More Deferments for New Borrowers

The new Senate proposal eliminates economic hardship and unemployment deferments for anyone taking out loans after July 1, 2026. That means all borrowers—regardless of job status—must make at least the minimum $10 monthly payment under RAP.

This could be especially hard for gig workers, caregivers, or recent grads struggling to find steady work.

As someone who deferred payments twice during early-career layoffs, I can say this change would’ve hit me hard. It’s one thing to owe—it’s another to owe without income flexibility.

College Accountability Without the “Risk Sharing”

While the House version included a controversial “risk-sharing” clause forcing colleges to reimburse defaulted loans, the Senate took a different route. Schools could lose access to federal aid (Title IV) if a high number of their grads earn below a certain wage threshold in 2 of 3 years post-graduation.

On the plus side, this nudges institutions to align programs with actual job outcomes. It’s also tied to a proposed Workforce Pell Grant, targeting short-term training programs (150–600 hours) that feed into in-demand jobs.

Pell Grants Stay—With Strings

Unlike the more aggressive House proposal, the Senate keeps traditional Pell Grants and subsidized undergraduate loans intact. But it adds stricter eligibility rules. Students with high family incomes—or those already receiving large private scholarships—may see reduced Pell support.

What’s Next?

Congress has until July 4, 2025 to reconcile this Senate bill with the House version. If they succeed, the law would go into effect by July 1, 2026.

Borrowers currently on SAVE, PAYE, REPAYE, or ICR could be migrated into one of the two new plans, facing higher payments and a longer timeline for forgiveness. If you’re thinking of grad school or relying on PLUS loans for your kid, it’s time to explore new budgeting strategies.

FAQs

Will current borrowers be affected?

Yes. If you’re in an income-driven plan like SAVE, PAYE, or REPAYE, you’ll likely be moved into RAP or the new IBR. Expect changes in payment amounts and longer forgiveness timelines.

When do these changes start?

July 1, 2026, for new loans. Plan changes could start sooner—within nine months of the law passing.

Are any deferments still available?

Only existing loans will keep access to economic hardship or unemployment deferment. New loans after 2026 won’t have those options.