As we enter the summer months, many taxpayers are eagerly awaiting their tax refunds, but if you’ve been anxiously checking your bank account or mailbox, you may have noticed an unexpected delay. It’s a reality that can cause anxiety for those who depend on that refund, whether for paying bills, taking a vacation, or saving for future expenses. If your IRS tax refund hasn’t arrived yet, you’re not alone. There are a few reasons why your payment might be delayed—and some steps you can take to help resolve the issue.

IRS Tax Refunds in June 2025

| Insight | Statistic/Fact |

|---|---|

| Refund Delay Trends | Refund delays are increasing, with a 10% rise in delayed payments compared to last year. |

| Audit-Related Delays | Around 3% of all refunds are delayed due to IRS audits or reviews. |

| E-file vs. Paper Filing | E-filing results in a refund 21 days faster than paper filing. |

| Changes in Tax Law | Tax reforms in 2025 may lead to additional processing time for more complex returns. |

While waiting for a tax refund can be stressful, the key is to stay patient and proactive. If your refund is delayed, check for filing errors, use the IRS tools available to track it, and contact the IRS if necessary. For future filings, e-filing is the best way to avoid delays and ensure a smoother tax season.

By understanding the potential causes for delays and taking the necessary steps to resolve them, you can minimize your waiting time and ensure your tax refund gets to you as quickly as possible.

Common Reasons for IRS Tax Refund Delays

Understanding why your refund might be delayed starts with knowing what could hold up the process. While the IRS generally aims to process refunds within 21 days for e-filed returns, several factors can lead to unexpected delays.

1. Changes in Tax Law

Tax law changes for 2025 might cause delays in processing your refund. For instance, if you qualify for new credits or deductions, your return may require extra review, which can slow down the process. Even seemingly small tweaks to tax law—such as changes to the child tax credit, standard deductions, or specific deductions—can require additional checks by the IRS.

2. Filing Errors or Inaccuracies

Simple mistakes, like misspelled names, incorrect Social Security numbers, or transposed digits on your bank account information, can cause a delay in your refund. If the IRS finds an issue with your return, they’ll likely reach out to you for clarification, which could take weeks to resolve.

3. Taxpayer Audits and Reviews

The IRS may place your return under review for a variety of reasons, even if you’ve done everything correctly. Sometimes, a random audit can delay the processing of your refund. According to the IRS, around 3% of all returns are selected for manual review, which can add significant time to the refund process.

4. Paper vs. E-filing

If you filed a paper return, expect a longer wait. E-filed returns are typically processed faster, often within 21 days, while paper returns can take several weeks—sometimes even months—to process. If you haven’t already filed, consider switching to e-filing in future years to speed things up.

5. Incorrect or Missing Forms

Sometimes, delays happen because the IRS hasn’t received all necessary forms, or there’s a mismatch with the documentation you provided. If you filed for specific credits or deductions (like the Earned Income Tax Credit or Child Tax Credit), make sure you’ve submitted the right paperwork. A missing form could delay your refund by several weeks.

6. Identity Theft and Fraud Prevention Measures

One of the primary reasons for delays in 2025 is the IRS’s increased focus on preventing fraud and identity theft. If the IRS flags your return as potentially fraudulent or if you are a victim of identity theft, your refund may be delayed significantly as they perform extra checks.

How to Check on the Status of Your Refund

If you haven’t received your tax refund yet, it’s natural to want to know where it is. Fortunately, the IRS provides tools to track your refund’s status.

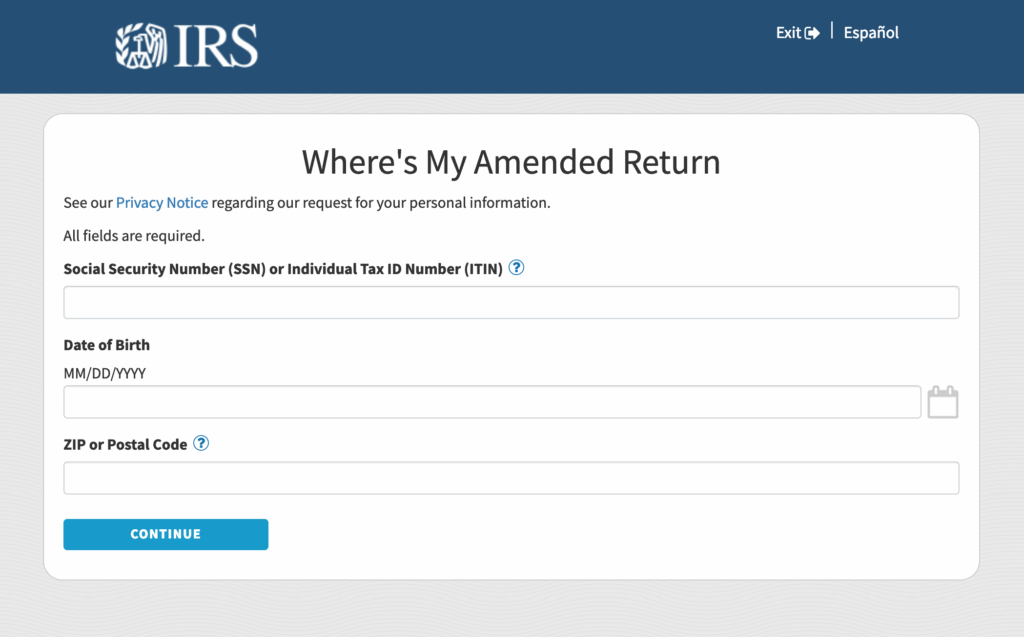

IRS “Where’s My Refund?” Tool

The best way to check the status of your refund is to use the IRS’s “Where’s My Refund?” tool, available on their website or through their mobile app, IRS2Go. This tool provides updates on whether your refund is approved, being processed, or if additional information is required.

To use the tool, you’ll need:

- Your Social Security number or ITIN

- Your filing status (single, married filing jointly, etc.)

- The exact refund amount you’re expecting

If you’ve already used this tool, remember that it’s updated once every 24 hours, typically at night. Checking multiple times in a day won’t speed up the process, but it can help keep you informed.

IRS Phone Assistance

If you’ve checked the online tool and still have questions, or if it shows that your refund is “delayed” or “under review,” you can contact the IRS by phone. The toll-free number for refund inquiries is 1-800-829-1040. Be prepared for long wait times, especially during peak tax season.

What You Can Do If Your Refund Is Delayed

If you’ve encountered a delay with your refund, there are a few steps you can take to get things moving.

1. Check Your Filing Accuracy

Review your tax return to make sure there are no errors. Common mistakes include incorrect personal details, incorrect bank account numbers for direct deposit, or failing to include necessary forms. You can file an amended return if you find mistakes, but keep in mind this could further delay your refund.

2. File Electronically in Future Years

If you filed your tax return on paper, consider switching to e-filing next year. The IRS processes e-filed returns much faster, reducing your chances of experiencing delays in the future.

3. Contact the IRS

If your refund is significantly delayed and the online tools haven’t provided an update, you can contact the IRS directly for more information. Be aware that you may face long hold times, but speaking with an IRS representative can provide clarity on the situation.

4. Consider an Appeal

If the IRS has denied a refund or imposed a penalty, you can appeal their decision. Be sure to submit any required documents and respond promptly to any IRS notices.

5. Protect Against Identity Theft

If you suspect that your tax refund delay may be due to identity theft, consider taking steps to protect your information. The IRS offers a tool called “Identity Protection PIN” (IP PIN), which can help prevent fraud. If you believe you’ve been affected, the IRS has a dedicated Identity Protection Unit to assist you in recovering your tax refund.

What to Expect for Refunds in June 2025

Looking ahead to June 2025, expect potential delays due to the complexities of new tax laws. With the IRS’s increasing focus on fraud prevention, additional reviews of returns, especially for taxpayers claiming new credits or deductions, are likely. Additionally, as many taxpayers file during the spring, the summer months may see slower processing times due to a backlog.

Stay Informed

With tax laws constantly changing, it’s crucial to stay informed on the latest updates. Consider subscribing to IRS newsletters or following trusted tax professionals to ensure you’re prepared for any delays that might affect your refund.

How Can You Prevent Future Refund Delays?

While waiting for a refund can be frustrating, there are steps you can take now to minimize the chances of facing delays next year.

1. Keep Your Tax Documents Organized

Maintain thorough records of your income, deductions, and credits. Having these documents organized ahead of time reduces the risk of missing forms or making errors on your return.

2. Update Your Information

Ensure that the IRS has your correct mailing address and bank account details. Any changes to your information can lead to delays, so staying up to date can prevent issues.

3. File Early

Filing your taxes early in the season gives you a cushion in case of any issues. The earlier you file, the sooner you’ll receive your refund—especially if there are no issues with your return.