Thinking about hitting 65 and tapping into Social Security? The truth might surprise you. Here’s a clear-eyed look at what most Americans actually receive—and why that amount may not cut it on its own.

Social Security Actually Pays at 65

| Key Insight | Stat |

|---|---|

| Average monthly benefit at age 65 | $1,583 |

| Men vs. women benefit disparity | Men: $1,756 · Women: $1,426 |

| Full retirement average (age 67‑70) | ~$1,976‑2,002 |

At 65, the average Social Security benefit is not a full income replacement. Many retirees take a 13% hit by claiming early. For most, Social Security is one piece of the retirement puzzle—not the whole picture. If you’re relying on it, plan smart: delay if you can, save more, and consider income supplements.

What You Actually Get at 65

At age 65, many assume they’re receiving “full” benefits—but not quite. The full retirement age (FRA) is 67 for most folks now, meaning benefits at 65 are reduced to about 86.7% of full value. On average, that comes out to $1,583/month—around $19,000 a year.

Gender Gap Still Real

There’s a noticeable divide: men typically receive about $1,756/month, while women average $1,426/month at 65. That’s roughly 20% less, reflecting disparities in lifetime earnings and career breaks.

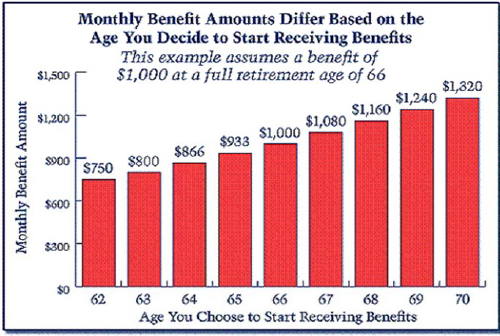

Full and Delayed Benefits

Wait until FRA (typically 67), and you’ll hit the average monthly benefit of roughly $1,976/month. Hold off until age 70, and delayed credits could boost your check to as much as $5,108/month, although that top tier is rare and requires max lifetime earnings.

Why It May Be Less Than You Think

- Reduction for Early Filing: Claiming at 65 means taking an ~13.3% cut from full benefits.

- Benefit Formula Limits: SSA calculates based on your top 35 earning years—it favors middle-age workers and caps high earners.

- Inflation vs. COLA: Though benefits get annual Cost-of-Living Adjustments (2.5% in 2025), those don’t always match your actual expenses—especially healthcare.

Real World: Why You Might Still Struggle

With ~$1,583/month from Social Security, many retirees fall short. The average 401(k) balance for ages 65–69 is around $253K, which under the 4% withdrawal rule yields ~$800/month. Combined, that’s about $2,400/month, which doesn’t go far once housing, medical costs, and everyday expenses enter the picture.

What You Can Do Next

Delay Claiming Benefits

Each year you delay past FRA up to age 70, you gain an 8% yearly bump—a powerful boost.

Increase Savings

Build your nest-egg through 401(k)s and IRAs. Compound interest rocks in your 50s and 60s.

Plan Strategically

Use SSA tools like the Quick Calculator to project your benefit scenarios.

Consider Part-time Work

Even a small part-time income can help delay claiming benefits and reduce early withdrawal penalties.

FAQs

What is the average Social Security check at 65?

About $1,583/month.

Why isn’t full Social Security at 65?

Because FRA is 67 for most now; claiming early reduces benefits by ~13%.