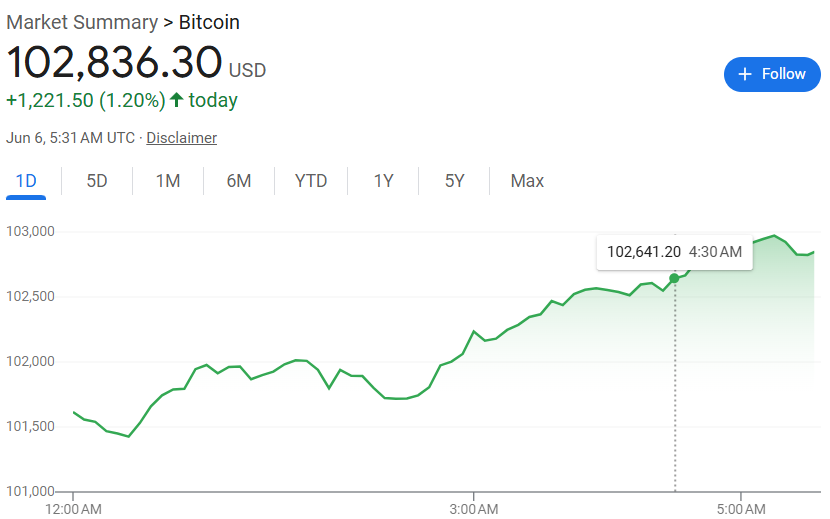

Bitcoin just hit a new all-time high of $111,800, but the celebration was short-lived. The price has since pulled back to around $102,800, and seasoned investors—those holding BTC for over a year—are beginning to take profits. This shift signals a critical tipping point in the market, raising questions about what’s next for the cryptocurrency.

Bitcoin Just Hit a Critical Tipping Point

| Insight | Data Point |

|---|---|

| Record Profit-Taking | Long-term holders realized over $1B/day in profits last week |

| Institutional Accumulation | Public firms added 218,000 BTC in 2025 |

| Support Levels | Key support at $103.7K and $95.6K |

Bitcoin’s recent price movements highlight a critical phase in its market cycle. The actions of long-term holders, coupled with institutional interest, are shaping the current landscape. As the market navigates this tipping point, investors should stay informed and consider both macroeconomic factors and on-chain data to make strategic decisions.

Why Are Long-Term Holders Selling Now?

The recent surge to $111,800 provided an opportune moment for long-term holders to realize significant profits. According to Glassnode, these investors have been leading the profit-taking wave, with realized profits spiking to $1.47 billion per day, marking the fifth major profit-taking event in this cycle. This behavior suggests a strategic move to capitalize on gains accumulated over the past year.

Interestingly, while some long-term holders are selling, others are accumulating. Data shows that between March 3 and May 25, 2025, the total long-term holder supply increased by over 1.39 million BTC, indicating continued confidence in Bitcoin’s long-term value.

Institutional Investors Step In

As individual investors take profits, institutional players are filling the gap. A recent report by Bitwise highlights that public companies have increased their net Bitcoin holdings by 218,000 BTC in 2025. This trend underscores a growing institutional interest in Bitcoin as a strategic asset.

However, it’s worth noting that institutional involvement can introduce volatility. For instance, in Q1 2025, institutional Bitcoin ETF holdings saw a 23% decline, marking the first quarterly drop since the launch of U.S. spot ETFs.

Market Dynamics and Future Outlook

The current market dynamics suggest a period of consolidation. With key support levels at $103.7K and $95.6K, the market is testing the resilience of recent gains. Analysts point out that such corrections are typical in bull cycles and can provide healthy resets for future growth.

Moreover, the behavior of long-term holders—balancing between profit-taking and accumulation—indicates a nuanced market sentiment. While some are capitalizing on gains, others are reinforcing their positions, reflecting a complex interplay of strategies among seasoned investors.