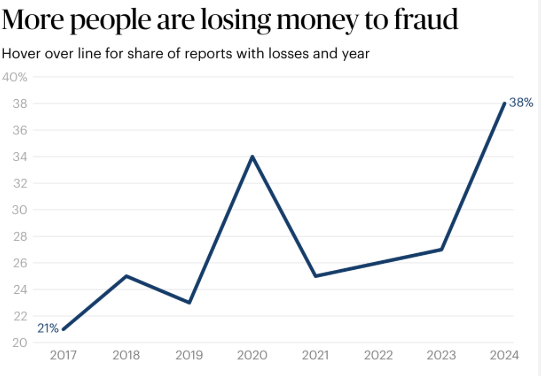

Investment scams have become an increasingly pervasive threat in the U.S., causing Americans to lose a staggering $5.7 billion in just one year. These scams have taken on various forms, from fake cryptocurrency schemes to fraudulent real estate deals, and they’re often more sophisticated than ever. Whether you’re an experienced investor or just starting to dip your toes into the market, it’s crucial to stay alert to potential fraud. Experts agree that knowing how to identify these scams and understanding the warning signs is your best defense.

Americans Lost $5.7B to Investment Scams Last Year

| Insight | Stat/Info |

|---|---|

| Investment fraud is on the rise | Americans lost $5.7 billion in investment scams in 2023 |

| Fake cryptocurrency scams are prevalent | Over 20,000 crypto-related scams were reported in 2023 |

| Age group most targeted | People aged 30-50 are the most common victims of investment fraud |

The rise in investment scams has left many Americans reeling from financial losses. However, by staying vigilant, doing thorough research, and consulting trusted experts, you can protect yourself from falling victim. Remember: if it sounds too good to be true, it probably is.

By understanding the tactics used by scammers and following the steps outlined above, you can help ensure that your investments are safe and sound, keeping your hard-earned money where it belongs.

The Growing Threat of Investment Scams

Scams that prey on investors have been around for decades, but in recent years, they’ve become far more sophisticated. The Federal Trade Commission (FTC) reports that the total losses from investment fraud in 2023 were a jaw-dropping $5.7 billion. The rise in cryptocurrency scams, phishing attacks, and fraudulent robo-advisors has made it easier for scammers to target unsuspecting individuals.

The typical fraudster might promise large returns with little to no risk, preying on the hope and greed of potential victims. Unfortunately, these scams often succeed, leaving victims financially devastated. Even experienced investors are not immune, as fraudsters use sophisticated techniques to mimic legitimate companies or investment platforms.

Common Types of Investment Scams

- Ponzi Schemes: These scams promise high returns, but instead of generating profits through legitimate investments, they pay returns to earlier investors using the capital from newer investors. Eventually, the scheme collapses.

- Fake Cryptocurrency Investments: Crypto scams surged in 2023, with fraudsters promising massive returns in exchange for “early” investments in a new digital currency or crypto-based platform. Often, these schemes vanish once the money has been collected.

- Fake Real Estate Deals: Scammers pose as legitimate property investment firms, convincing individuals to invest in fake or overvalued real estate ventures, sometimes offering attractive incentives like guaranteed returns.

- Phishing Attacks and Fake Brokerages: Many scams involve fraudulent emails, websites, and social media profiles that impersonate legitimate investment firms, tricking investors into revealing personal details or making payments.

The Telltale Signs of an Investment Scam

Recognizing an investment scam early can save you a lot of money and heartache. Experts suggest looking for a few common red flags:

- Promises of Guaranteed Returns: If something sounds too good to be true, it probably is. No legitimate investment can guarantee returns, especially high ones, with little to no risk.

- Unregistered Brokers or Firms: Always check if the brokerage or firm is registered with the Securities and Exchange Commission (SEC) or the Financial Industry Regulatory Authority (FINRA). You can use the SEC’s Investment Adviser Search tool to verify legitimacy.

- Pressure Tactics: Fraudsters often rush investors into making quick decisions, telling them the opportunity is “limited” or “only available now.” If you’re feeling pressured, take a step back and reevaluate.

- Vague or Unclear Details: Be wary if the investment opportunity lacks clear information about how it works or where your money is going. Legitimate firms should be transparent and forthcoming with details.

Expert Strategies for Protecting Yourself

So how can you protect yourself from becoming a victim of investment fraud? Experts recommend a few simple but effective steps:

1. Do Your Research

Before committing to any investment, always research the firm or individual offering it. Look for reviews, complaints, and any regulatory sanctions. If the investment is too complex or hard to understand, it might be a scam.

2. Check for Red Flags

As mentioned, some signs of fraud are easier to spot than others. Always be cautious of promises of high returns with little to no risk. If something seems off, it’s better to walk away than regret it later.

3. Don’t Share Personal Information

Be careful when disclosing personal details, especially through unsolicited phone calls, emails, or text messages. Scammers often use this information to steal your identity or access your bank accounts.

4. Consult a Trusted Financial Advisor

If you’re unsure about an investment, speak to a certified financial planner or advisor. A second opinion can be invaluable in helping you avoid a potentially costly mistake.

5. Report Scams

If you suspect you’ve encountered a scam, report it immediately to the authorities. The FTC and the SEC both have platforms for reporting suspicious activities. Early reporting can prevent further losses and help protect others from falling victim.

Real-Life Case: How a Retiree Lost $250,000 to a Fake Crypto Scheme

A recent report highlighted the case of a retiree in his 60s who lost over $250,000 in a fake cryptocurrency scam. He had been approached by an online “advisor” who convinced him that a new cryptocurrency was poised to explode. The retiree, excited by the promise of high returns, transferred his savings to the account provided by the scammer. Shortly after, the so-called “investment platform” disappeared, and so did his money. This incident serves as a cautionary tale about how anyone, regardless of age, can fall prey to these scams.

Protecting Yourself Online: Social Media Scams

Social media has become a hotbed for investment scams. Fraudsters often use Facebook, Instagram, Twitter, and even TikTok to promote fake investment opportunities, leveraging influencers or fake testimonials to lure in victims. Experts warn that you should avoid making financial decisions based on social media posts, especially if you don’t know the person or organization involved.

In fact, the FBI’s Internet Crime Complaint Center (IC3) reported that social media scams accounted for nearly 30% of all investment-related fraud in 2023. Always verify the legitimacy of the person or organization you’re dealing with before making any transactions.

How to Verify Investment Opportunities

To avoid getting scammed, here are some tools and resources that can help you vet investment opportunities:

- The SEC’s EDGAR Database: This allows you to search for public filings by companies, which can help you verify if an investment is legitimate.

- FINRA’s BrokerCheck Tool: This helps you verify the background of brokers, advisors, and firms to ensure they are registered and in good standing.

- FBI Internet Crime Complaint Center (IC3): Use this tool to report any suspected online fraud, including investment scams.