Since launching a new round of tariffs in early 2025, Trump’s pledge to fix “terrible” trade imbalances has unraveled—but it’s doing some real economic damage. Trump’s bold tariff gambit promised a stronger U.S. economy. Instead, it’s putting pressure on growth, pushing up costs, rattling markets, and risking recession. The economic fundamentals simply don’t support sweeping trade disruption—and the clock is running.

Trump’s Big Trade Promises Are Crumbling

Trump’s trade crusade promised to revive U.S. exports and rein in deficits—but delivered recessionary dents instead. Mounting evidence shows tariffs are economic blunt weapons: they dent growth, spark inflation, unsettle markets, and invite retaliation and legal pushback. So unless policy moves toward nuanced industrial strategy and bipartisan trade deals, the economic costs could outweigh any political wins.

The Promise vs. the Reality

Trump promised that broad tariffs would slash trade deficits and supercharge U.S. manufacturing. But a sharp GDP contraction—0.3% in Q1 2025 against expectations—reveals the opposite. The Commerce Department explicitly pinned the slowdown on “record-high trade deficits and companies rushing to import goods ahead of new tariffs”.

Meanwhile, Barclays has warned that reversing the trade deficit structurally could only happen via a “severe recession”. And the Wharton economic model paints a bleak picture: long-term tariffs may slash GDP by ~6% and wage income by ~5%, costing a middle-income household over $20K across its lifetime.

Market Whiplash and Volatility

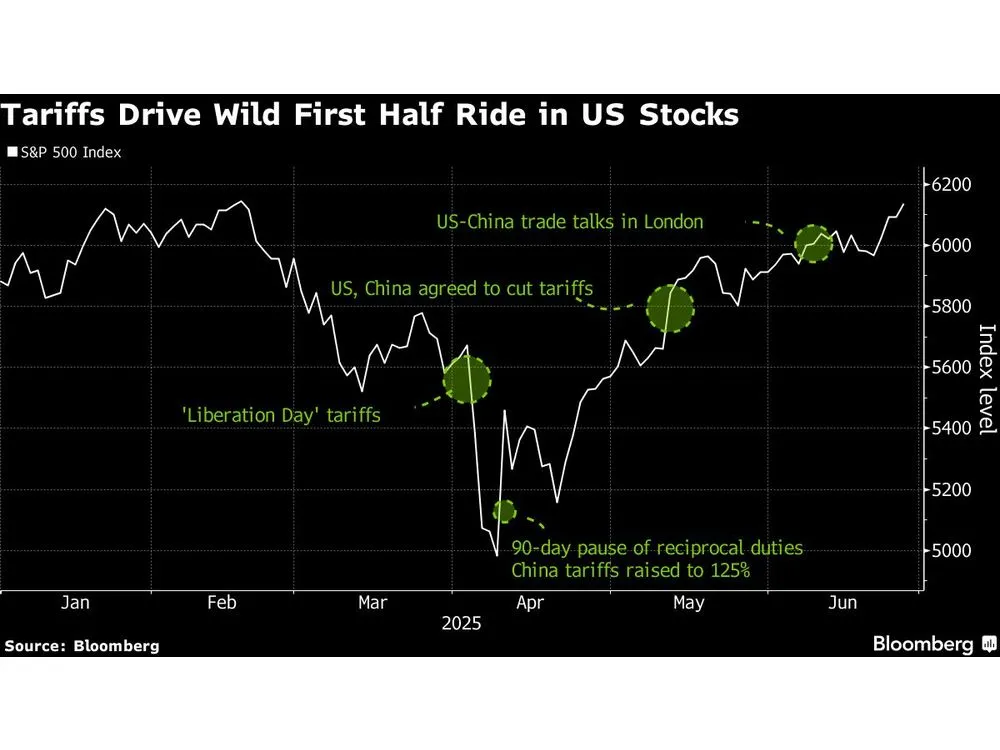

Early-April market panic—stemming from “Liberation Day” tariffs affecting nearly all U.S. imports—sparked a crash akin to the 2020 pandemic lows. While equity markets later rebounded, driven partly by easing tensions, the damage to investor confidence and supply chains lingered.

Government vs. Consumer Pain

Yes, tariffs do raise revenue—up to $3.9 trillion over 10 years in some models. But before Treasury sees that cash, economic stalls bite households and businesses. J.P. Morgan estimates growth will slow, inflation will heat up, and net deficits will persist.

The Congressional Budget Office warns that expanding tax cuts and spending under Trump’s proposed bills could push U.S. federal deficits up by $3.4 trillion over ten years—weakening the dollar and worsening trade imbalances.

Global Blowback & Legal Barriers

Tariffs haven’t just pinched the U.S.—Canada, Mexico, China, and the EU launched retaliatory duties, disrupting North American supply chains and raising consumer prices. The BIS warns that escalating protectionism could spark global financial panics, especially in bond markets.

On the legal front, a federal court in May struck down “Liberation Day” tariffs, ruling that executive overreach under IEEPA violated trade commerce authority—halting those duties permanently.

Risk Outlook: Recession & Rising Prices

Oxford Economics currently pegs recession odds at ~35% over the next year—well above the usual 15% baseline—due to policy uncertainty and trade shock risks. Inflation hovers near 3%, cooling no sooner than mid‑2025 .

Amplified tariffs on metals, autos, machinery, and agriculture have been flagged by analysts as catalysts for supply shocks and higher end‑user prices.

What’s Next—and What It Means for You

- Households: Brace for higher prices and stagnant wages. Middle-income families may lose $20K+ over time.

- Businesses: Uncertainty disrupts investment and planning. Manufacturers and agribusinesses may feel pain first.

- Markets: Volatility is here to stay. Bond and equity selloffs could repeat if tariffs expand again.

- Washington: Ongoing Senate battles over tax bills and mounting legal limits on executive trade powers may slow future tariff implementation.

FAQs

Will tariffs reduce the U.S. trade deficit?

Unlikely. Economists say deep deficits are tied to savings and consumption, not imports alone. Broad tariffs could shrink GDP before fixing deficits.

What sectors are hardest hit?

Steel, autos, agriculture, and electronics face rising costs. U.S. manufacturers using imported inputs and farmers hit by retaliation feel it most .

Could a recession still hit?

Yes. Oxford Economics gives a ~35% chance in the next 12 months—elevated risk tied to policy uncertainty and external shocks.