As Congress barrels toward a high-stakes July 4 vote, a quiet but explosive standoff is unfolding: Senate Republicans are refusing to formally consult the Senate parliamentarian on whether their plan to make the Trump tax cuts permanent actually violates budget rules.

Senate GOP Refuses to Meet Parliamentarian

| What You Need to Know | Stat/Detail |

|---|---|

| Byrd Rule restricts non-budget items in reconciliation | Must not add to deficit beyond 10 years |

| Parliamentarian rulings have struck Medicaid/SNAP cuts | Seen as “policy, not budget” |

| GOP’s tax cut extension likely increases long-term deficit | Could be ruled “extraneous” |

In a Senate known for its arcane procedures and dramatic late-night showdowns, this standoff over the parliamentarian could shape the fiscal future of the country. And all because the GOP doesn’t want to knock on her door.

What’s the Byrd Rule—and Why Does It Matter?

Under the Byrd Rule, any provision included in a reconciliation bill must directly affect federal spending or revenues—and it can’t increase the federal deficit beyond a 10-year window.

That’s why many of the original Trump tax cuts in 2017 were set to expire in 2025: they couldn’t pass muster under this rule unless offset.

Now Republicans want to extend those cuts permanently—but without new offsets. That raises the billion-dollar question: will that break the Byrd Rule?

Senate Parliamentarian Elizabeth MacDonough is the person who would usually decide.

Senate GOP: Skirting or Strategizing?

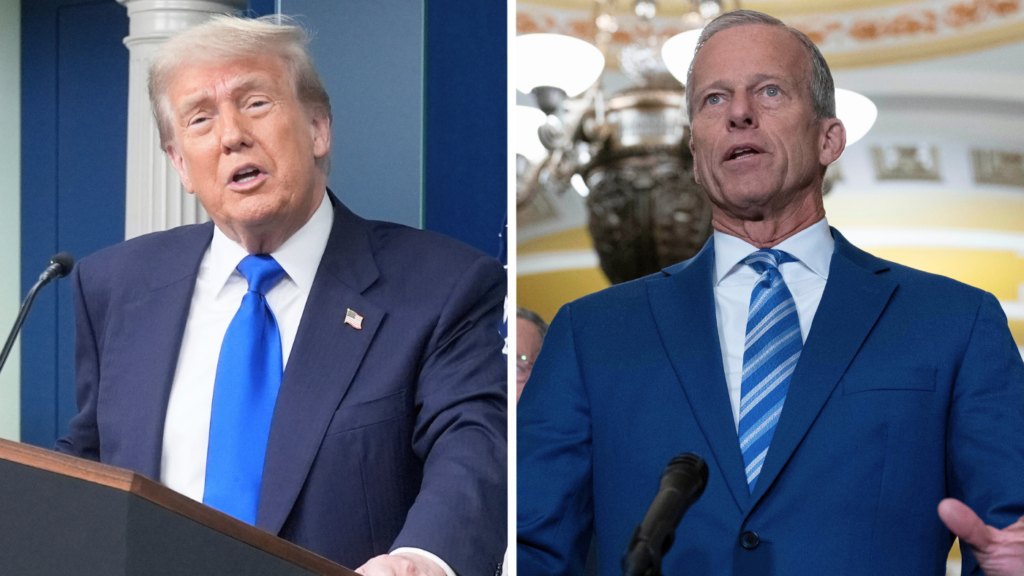

Instead of asking MacDonough to weigh in, Senate Republicans are taking a different approach: don’t ask, don’t get blocked. Senate Budget Committee Chair Lindsey Graham argues he has the authority to decide the budget “baseline” and insists the parliamentarian shouldn’t rule on long-term tax scoring.

But that interpretation doesn’t align with past Senate practice. “The parliamentarian has been the referee on reconciliation for decades,” says Molly Reynolds, a senior fellow at the Brookings Institution. “Choosing not to ask for her input doesn’t make the rules go away.” It’s a risky bet—and one that could lead to chaos on the Senate floor.

Parliamentarian’s Track Record: A Warning Sign

This isn’t Elizabeth MacDonough’s first rodeo. Earlier this month, she ruled against key Republican attempts to cut Medicaid and restructure provider taxes, calling them “primarily policy” in nature. Those parts were swiftly stripped from the bill.

The GOP’s current tax cut provision could face a similar fate. “I remember watching the MacDonough rulings during the ACA repeal fights,” I told a colleague last week. “Her judgments are measured, but once made, they’re near impossible to overturn.”

What Happens If They Skip the Ruling?

By not getting a formal opinion now, Republicans may be painting themselves into a corner. Here’s how it could play out:

- Best case: Parliamentarian allows the tax cut extension during floor debate.

- Likely case: She rules it extraneous—forcing removal unless overridden with 60 votes.

- Worst case: The Senate passes the bill, and the provision is invalidated afterward—gutting their central victory.

And that override? Not gonna happen. Democrats are united, and even some moderate Republicans have pledged not to go around the parliamentarian.

The Clock Is Ticking

Senators are trying to finalize what’s been dubbed the “One Big Beautiful Bill”—a sweeping package that extends tax cuts, hikes defense and border spending, and slices Medicaid and SNAP.

With the July 4 deadline looming, they’ve already removed or revised several provisions following MacDonough’s feedback. But the tax cut extension is still in limbo. And without a ruling, that limbo could become a freefall.

So, Are the Trump Tax Cuts Breaking the Rules?

We don’t have an official answer—yet. But the refusal to ask the referee is raising eyebrows. Democrats argue that if Republicans really believed their proposal met the reconciliation test, they’d go to MacDonough and prove it. Instead, they’re speeding toward a vote that could end in a procedural trainwreck. And that could have ripple effects far beyond this bill.