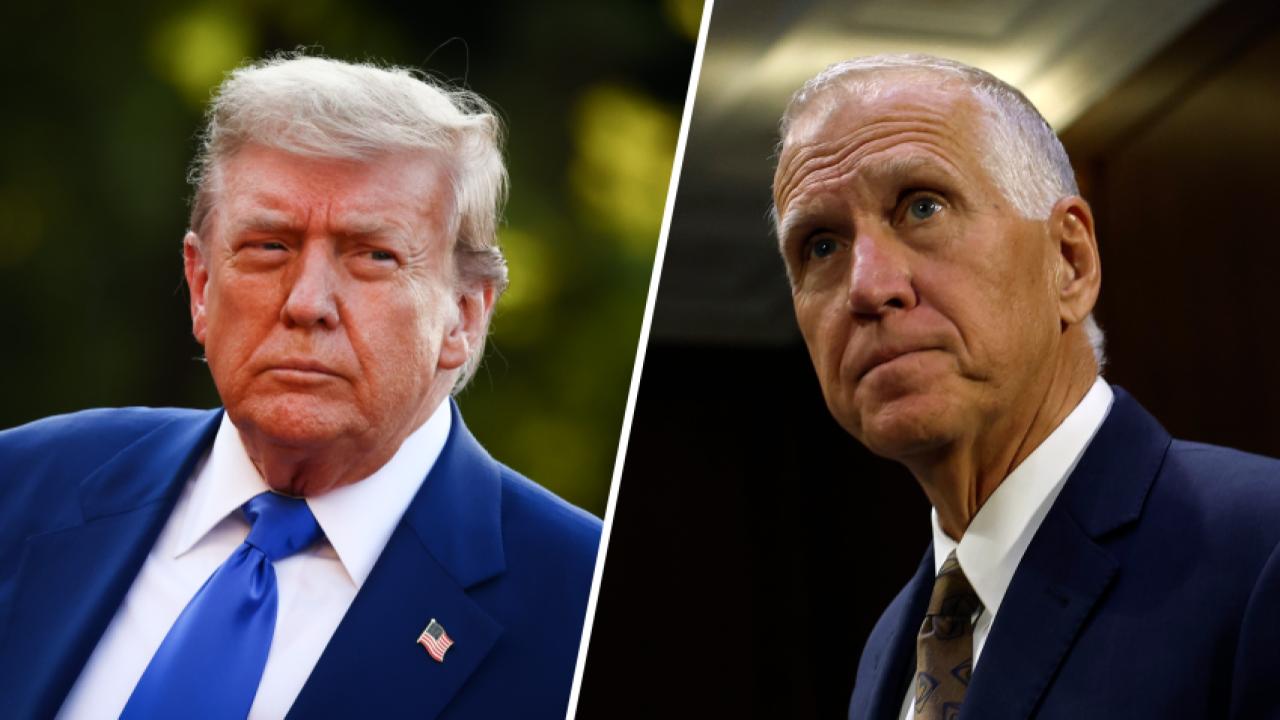

In a bold move that has left many experts and political analysts reeling, former U.S. President Donald Trump has reportedly pulled the United States out of all ongoing trade discussions with Canada. The reason? A contentious Digital Services Tax (DST) imposed by the Canadian government. This shock decision is reverberating across global markets, with business leaders and policymakers alike questioning what this means for the future of cross-border trade between the two North American neighbors.

Trump Shocks the Nation: Ends All U.S.-Canada Trade Talks

| Takeaway | Stat/Fact |

|---|---|

| Trump’s decision halts major trade talks. | U.S.-Canada trade discussions, which were focused on multiple sectors, are now suspended indefinitely. |

| Canada’s DST is seen as a direct challenge to U.S. tech giants. | The Canadian DST targets tech companies earning large revenues from digital activities in Canada, particularly U.S. giants like Google and Amazon. |

The recent decision by Trump to end trade talks with Canada is a bold and potentially game-changing move in the world of international trade. The underlying issue—the controversial Digital Services Tax—is more than just a tax on tech companies; it’s a battle over how the digital economy will be governed. With U.S.-Canada trade talks at a standstill, the future of cross-border relations is uncertain. What’s clear, however, is that the outcome of this conflict will have lasting consequences for global trade dynamics in the years to come.

Why the Digital Services Tax is at the Heart of This Dispute

The digital services tax, introduced by Canada in 2020, is designed to target major tech companies, primarily those based in the United States, that generate significant income through digital advertising and online sales in Canada. The DST is set at a rate of 3% on revenues earned by companies that exceed a certain threshold. Critics argue that the tax unfairly targets U.S. firms, most notably the tech behemoths like Google, Facebook, and Amazon, who conduct a large portion of their business through online platforms and digital services.

Trump’s administration had long made it clear that it viewed such taxes as hostile to American businesses. Now, as the U.S. government under his leadership plans its next steps, the fallout could reshape trade relationships on the global stage.

What Does This Mean for U.S.-Canada Relations?

The timing of Trump’s decision is key, coming just as both nations were attempting to finalize a host of important trade agreements. With the United States and Canada being each other’s largest trading partners, this move is particularly significant. The U.S. exports billions of dollars’ worth of goods and services to Canada annually, while Canada also benefits from access to the immense U.S. market.

The suspension of these trade talks could have a profound impact on industries such as agriculture, energy, and manufacturing, all of which rely heavily on the seamless flow of goods across the U.S.-Canada border. But it’s the technology sector that may feel the sharpest sting. The issue of digital taxation has become a flashpoint in global trade, with other countries, such as France and the UK, also implementing similar taxes aimed at U.S. tech giants. Trump’s decision to suspend talks could signal a broader shift in U.S. trade policy, especially when it comes to digital taxation and its implications for tech giants.

How Did Canada React to the Move?

Canada, for its part, has stood firm on the DST, arguing that it’s necessary to ensure that international tech companies pay their fair share of taxes for the revenue they generate from Canadian consumers. The Canadian government has argued that such taxes are crucial in maintaining fairness in a rapidly evolving digital economy, where traditional tax rules often fail to account for the value generated by tech platforms.

Prime Minister Justin Trudeau’s office has yet to comment directly on the suspension of trade talks, but Canadian officials have repeatedly emphasized that the Digital Services Tax is a matter of national sovereignty. The Canadian stance is clear: this tax is not going anywhere, and if the U.S. wants to continue trade negotiations, it will have to accept it.

What’s at Stake for American Tech Giants?

The U.S. tech industry is perhaps the biggest player caught in the crossfire of this new economic conflict. Companies like Amazon, Apple, and Google have dominated the global market for years, but they’ve also drawn the ire of governments across the world for their perceived lack of contribution to national tax coffers. For these companies, paying a tax like Canada’s DST would cut into their profit margins. But the larger issue is about the principle: if the Canadian model spreads, it could set a precedent for other nations to follow suit.

For many in the tech world, this is about more than just money—it’s about controlling the rules of the digital economy. If individual countries like Canada can unilaterally impose taxes on digital services, U.S. firms might find themselves having to navigate a confusing patchwork of international regulations.

What’s Next for Trade Between the U.S. and Canada?

This sudden halt in trade talks leaves a lot of questions unanswered. While the U.S. has made it clear that it won’t tolerate what it sees as an unfair tax on its businesses, it remains to be seen how long this impasse will last. The question of whether this move is part of a larger strategy by Trump to reshape U.S. foreign policy toward a more isolationist stance is still up in the air.

For now, businesses on both sides of the border will have to adjust to a new reality, with the digital services tax at the heart of a broader trade standoff that could redefine North American relations for years to come.

Will Other Countries Follow Canada’s Lead?

Given the growing scrutiny of U.S. tech giants around the world, it’s likely that other countries will consider implementing similar taxes. France, for instance, has already passed its own version of a digital services tax, and countries like the UK and Italy are exploring similar measures. This trend could escalate tensions in global trade as governments seek to tap into the revenue generated by digital platforms.

The future of these taxes could hinge on international negotiations, such as those led by the Organisation for Economic Co-operation and Development (OECD), which is working on a global framework for digital taxation. The question now is whether countries like Canada will hold firm on their digital taxes or seek a multilateral solution that could ease tensions with major economies like the United States.