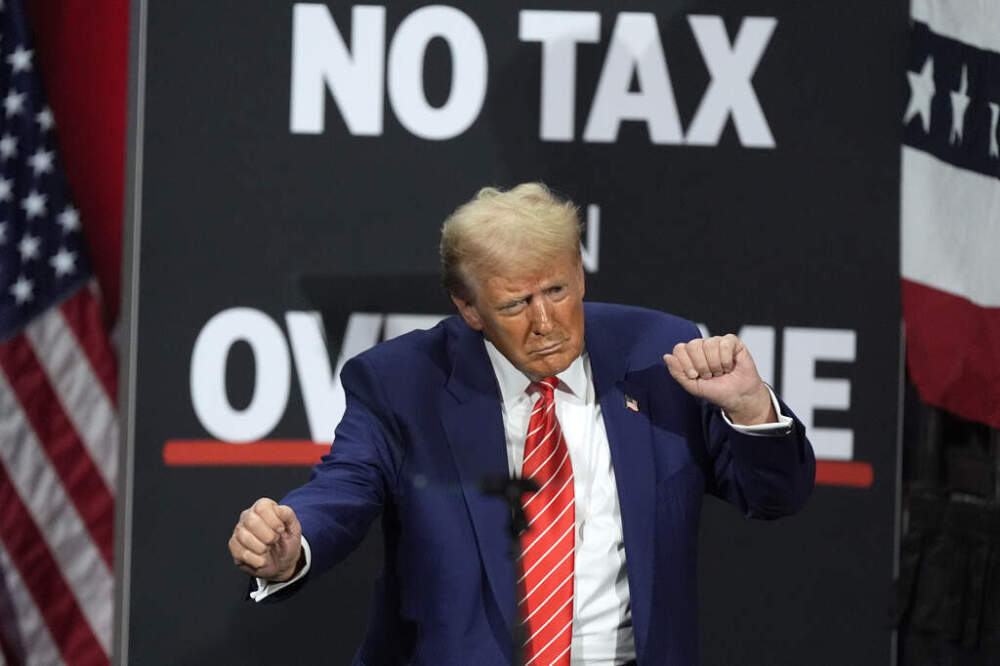

The new bill passed by former President Donald Trump’s administration is set to reshape the way Americans experience taxes, healthcare, and even how they raise their families. Whether you’re a small business owner, a working parent, or someone concerned about skyrocketing healthcare costs, this legislation is something you’ll want to understand.

How Trump’s Massive Bill Will Impact Your Taxes, Healthcare Costs, and Even Raising a Family

| Takeaway | Stat/Insight |

|---|---|

| Tax cuts for corporations and high earners | Trump’s bill includes a corporate tax rate reduction from 21% to 15%. |

| Healthcare premiums may rise for some families | Premiums could increase by up to 10% for households earning over $100,000. |

| Family support benefits may be reduced | Child tax credits are expected to decrease for middle-income families. |

The massive bill passed during Trump’s administration is a game-changer for many Americans. Whether it’s taxes, healthcare costs, or the support you receive for raising a family, this bill could have far-reaching effects. While there are some potential benefits, like corporate tax cuts and job growth, there are also significant drawbacks, especially when it comes to healthcare premiums and family support.

How the Tax Cuts Will Impact Your Wallet

One of the most discussed features of Trump’s bill is the tax cuts it brings. The corporate tax rate reduction from 21% to 15% will be a significant win for big businesses. However, the savings for small businesses and individuals may not be as dramatic. The personal tax cuts are designed to provide some relief, but they phase out over time, meaning that unless you’re in the highest tax brackets, the long-term benefits might not be as substantial as they seem.

For most middle-income families, the impact may feel minimal. However, high earners could see considerable savings. If you’re one of them, this bill could mean a noticeably lighter tax burden, which can free up funds for savings, investments, or other financial priorities.

Personal Insight: I’ve noticed from talking to professionals in finance that those in the highest income brackets are the ones most excited about the bill, as they’ll likely experience the largest benefits. But for the average American, the real effects may be felt only through indirect benefits, like potential job growth from tax savings for companies.

Healthcare Costs: Will You Pay More?

Another major element of this bill is how it will affect healthcare costs. One of the major concerns experts have raised is the likelihood of increased premiums. The bill is designed to roll back certain parts of the Affordable Care Act (ACA), potentially causing premiums to rise for many Americans, especially for those who earn above $100,000 a year. If you’re one of those families, expect to see a 10% rise in your premiums in the coming years.

This could be particularly painful for families who already struggle with healthcare costs. Lower-income Americans may find relief, though, as the bill does propose new subsidies. But these subsidies won’t necessarily cover the price hikes for everyone, and the increases could leave some middle-class families scrambling for more affordable options.

Quick Tip: If healthcare costs are a major concern for you and your family, it’s important to start planning now. Look into high-deductible health plans, health savings accounts (HSAs), or other options that can help you mitigate the impact of these potential cost increases.

Raising a Family: What’s Changing?

For those raising kids, there are both pros and cons to Trump’s new bill. The child tax credit is one area that has seen significant changes. While some families might still qualify for credits, the value of these credits is set to decrease over time. Families making over $200,000 might not receive the same benefits as before, which could mean higher taxes when it comes to dependents.

Additionally, the bill proposes cuts to social safety nets, which could lead to fewer programs available for families in need. This could directly impact things like subsidized childcare, nutrition programs, and other family-focused resources.

If you’re a working parent or someone who is trying to build a family, it’s essential to take a look at how these cuts might impact your finances and family life. Consider seeking advice from a tax professional who can help navigate these changes, especially when it comes to planning for future tax years.

What About the Economy?

Supporters of the bill argue that it will stimulate economic growth, leading to more job opportunities, especially for the lower-income workforce. Tax cuts for businesses could encourage companies to hire more workers, potentially leading to wage increases as demand for labor rises. However, critics worry that the bill could disproportionately favor the wealthy and big corporations, further exacerbating income inequality.

Will This Bill Create Jobs?

On the job front, the economic projections are mixed. The tax cuts aimed at big corporations are expected to encourage business investment and job creation. However, whether this trickles down to the average worker is still up for debate. Economists have cautioned that while the corporate tax cuts might boost job numbers in the short term, long-term benefits for employees are unclear.

How You Can Prepare

If you’re worried about how these changes might affect you, here are a few things you can do to prepare:

- Consult a Tax Professional: With tax changes ahead, it’s wise to consult an expert. They can help you understand how the changes will affect your personal taxes and what strategies might minimize your tax burden.

- Reevaluate Your Healthcare Plan: Consider reviewing your healthcare options, especially if you’re in a higher tax bracket. Look into different health plans or account options like HSAs to help buffer rising costs.

- Plan for Family Changes: If you have children, start planning for potential changes in tax credits or government subsidies. You might also want to investigate other ways to save for their future, such as 529 plans or other tax-advantaged accounts.

Frequently Asked Questions

How will Trump’s new bill affect my healthcare premiums?

Trump’s bill could lead to a 10% increase in healthcare premiums for households earning over $100,000 annually, as it rolls back parts of the Affordable Care Act.

Will the tax cuts benefit small businesses?

While the corporate tax cuts will likely benefit large companies the most, small businesses may see some tax relief, though it may not be as significant. Owners should explore all potential savings to maximize their benefits.

Will this bill impact child tax credits?

Yes, the value of child tax credits is set to decrease, and some middle-income families may find themselves ineligible or receiving reduced credits.

Will my healthcare options change under this bill?

Healthcare options could become more limited, and you may see premium increases depending on your income. Review your healthcare options to prepare for potential changes.