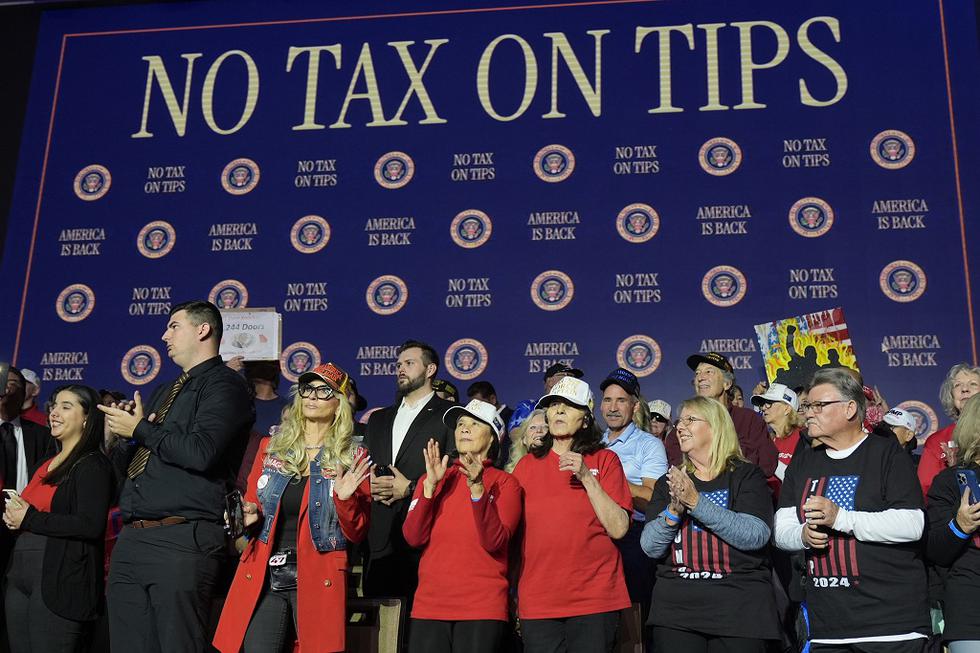

The “no‑tax on tips” proposal has stormed Congress, promising to put more cash in servers’ pockets—sounds great, right? But beneath the surface, it’s stirring deep rifts between tipped and non‑tipped workers, independent and chain restaurants, and policy wonks and activists. Here’s why this seemingly simple tax tweak is turning into a major fork in the road for the U.S. restaurant industry— and what it might mean for everyone from dishwashers to diners.

‘No‑Tax on Tips’ Idea Is Splitting the Restaurant Industry

| Takeaway | Stat |

|---|---|

| Senate passed “No Tax on Tips” Act unanimously | Applies to tips reported on W‑2s for workers earning under $160K |

| Florida’s average tip is 18.2%—among lowest in U.S. | Q1 2025, slight dip compared to 19.4% national average |

| 83% of tipped workers back the idea | Survey of frontline service workers |

The “no‑tax on tips” movement is more than a tax tweak—it’s a symbol of the broader tensions in U.S. hospitality: tipped vs untipped, “checks and balances” vs “checks and diner,” tradition vs fairness. What starts as clear federal relief can turn murky if base‑pay structures don’t evolve alongside it. Ultimately, lasting change will likely demand a more holistic labor reform—not just tax relief.

What’s the proposal?

Congress is advancing the No Tax on Tips Act, which would:

- Eliminate federal income tax on tips for employees earning up to $160,000 annually (Senate version also caps at the first $25,000 of tips)

- Still require Social Security, Medicare, and state taxes on tip income

- Apply for four years unless extended.

Backers include President Trump, former Vice President Harris, both parties in Congress, and major groups like the National Restaurant Association.

Who’s cheering—and why

- Servers & bartenders see an instant boost: an estimated 83% support the proposal, and it could mean thousands more in take‑home pay.

- Payroll simplicity advocates point out that tracked, W‑2–reported tips would be more transparent—though actually tracking them accurately remains a challenge.

- Industry lobbyists & chains support it for reducing payroll overhead and minimizing tax admin hassles.

Why many in the industry are raising concerns

1. Untipped kitchen staff feel left out

Groups like the Independent Restaurant Coalition argue the policy lifts only tipped roles—servers and bartenders—while leaving out 12+ million back‑of‑house workers such as dishwashers and cooks.

2. Doesn’t address the sub‑minimum wage

Federal law allows tipped workers to be paid as little as $2.13/hour base — the argument is that tax breaks won’t help if the system itself is structurally unfair.

3. Could exacerbate tipping inequality

Some economists warn employers might lean harder on tipping—reclassifying wages as tips—and may even reduce base pay, leaving workers more dependent on volatile tip income.

4. Tip‑pooling tensions

Tipped workers could be incentivized to opt out of pooling arrangements, straining front‑ and back‑of‑house morale and compounding inequity.

5. Administrative and software hassles

Payroll and POS systems will need to adjust. Even digital‑tip operators foresee complexity in tracking W‑2‑visible tip amounts—not a trivial lift.

Where the policy stands

- The Senate approved the act unanimously in May 2025

- The House included it in its budget resolution—now front‑of‑house vs back‑of‑house debates are heating up

- If passed and signed, it would take effect with the upcoming spending bill—but only for a limited period

Meanwhile, several states (CA, NY, IL, etc.) are exploring their own exemptions—while others have passed none.

A path forward—or a diversion?

Proponents argue it’s a clear, bipartisan win—five years of extra net income for tipped workers with minimal red tape. But critics say it sidelines essential reforms: ending the $2.13 federal tipped minimum wage, extending benefits to non‑tipped staff, and raising base pay across the board.

Voices from the field

- Elyanna Calle, bartender and union leader: “It’s not helping most kitchen workers…they’re being paid the least.”

- George Skandalos, owner of Maialina (Moscow, Idaho):

Runs a “service‑charge” model that shares across all staff—and would rather lift exemptions on service fees than just tips.

What restaurant pros should do now

- Review payroll & POS systems now—reporting requirements may change soon.

- Engage staff on tip‑pool dynamics to prevent culture clashes.

- Monitor local policy—state actions may compound or counter federal shifts.

- Advocate smartly—owners can support more equitable models like service charges or living‑wage guarantees.

FAQs

Does “no tax on tips” include Social Security or Medicare?

No. It only exempts federal income tax—Social Security and Medicare taxes still apply to all tip income.

Could employers reduce base pay?

Yes—economists warn employers might offset tax savings by keeping sub‑minimum wages artificially low or reclassifying full wages as tips.

What happens to service charges?

Current proposals focus solely on tips, not service charges. Many restaurants use service‑charge models that include back‑of‑house, which remain fully taxable.