The Senate GOP just dropped a legislative bombshell with its rewrite of Trump’s so-called “Big, Beautiful Bill,” radically altering tax policy and healthcare funding. The changes hit Medicaid hard, reinstate a strict cap on state and local tax (SALT) deductions, and trigger fierce infighting among Republicans.

Senate GOP Unveils Shocking Edits to Trump’s ‘Big, Beautiful Bill’

| Takeaway | Stat |

|---|---|

| Medicaid provider tax cuts | Drop from 6% to 3.5% by 2031 |

| Coverage loss from Medicaid changes | 11 million over 10 years |

| New SALT cap | $10,000 reinstated |

What Changed in the Senate Version?

Medicaid Takes a Major Hit

The Senate GOP’s version of the bill slashes the allowable Medicaid provider tax from 6% to just 3.5% in expansion states by 2031. That means fewer federal dollars for already strained state Medicaid programs. As someone who covered the ACA rollout in rural Kentucky, I’ve seen how crucial Medicaid is to hospitals on life support.

In addition, the bill reintroduces work requirements and imposes co-pays and tighter income checks. Analysts say these changes could remove coverage from up to 11 million Americans over the next decade. For states like West Virginia or Arkansas, the fallout could be enormous.

SALT Deduction Slashed

The Senate deal also claws back one of the House bill’s most popular tax breaks—a $40,000 cap on SALT deductions—reverting to the $10,000 limit from the 2017 Trump tax law. That’s triggered outrage from Republican lawmakers in high-tax states. “Dead on arrival if SALT cap lowered to $10K,” warned New York GOP Rep. Mike Lawler.

Other Key Shifts in the Senate Bill

| Policy | Senate Version | House Version |

|---|---|---|

| Child Tax Credit | $2,200 permanent | $2,500 through 2028, then $2,000 |

| Green-Energy Credits | Slower phase-out | Faster cuts |

| Business Tax Cuts | Permanent 20% deduction | Limited extension |

| Foreign Tax Penalty | Delayed to 2027 | Immediate application |

What’s Driving These Changes?

Conservatives like Sens. Ron Johnson and Josh Hawley pushed for more aggressive deficit trimming and deeper entitlement reform. Meanwhile, Senate moderates are wary of going too far. “These Medicaid cuts risk healthcare access in rural communities,” one Senate moderate anonymously told reporters.

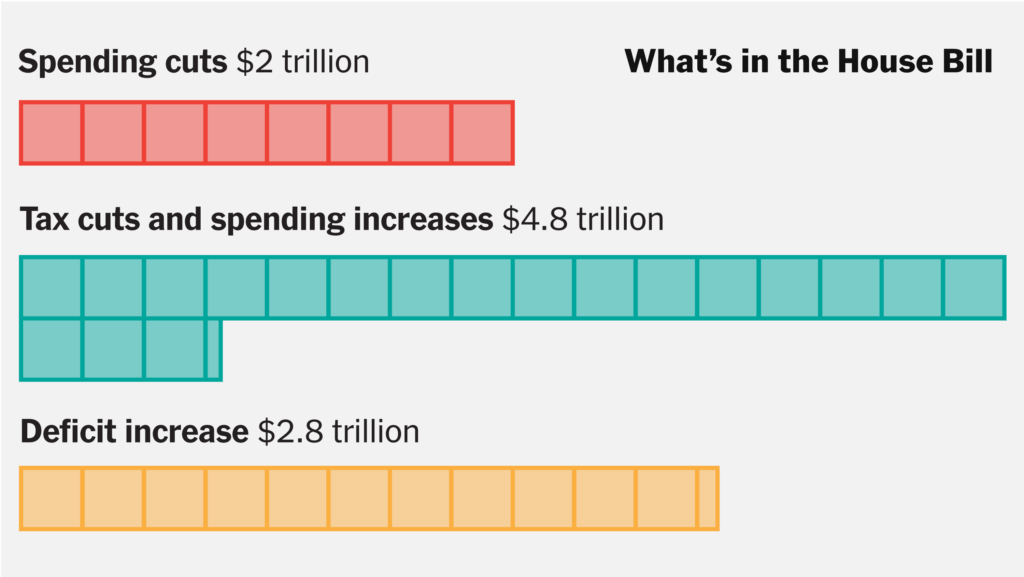

Fiscal hawks argue the revised bill reduces the deficit by about $600 billion compared to the House version. Still, the Congressional Budget Office estimates the total package will add $2.4 trillion to the national debt over a decade.

Political Fallout: A GOP Tug of War

House vs. Senate: The SALT cap is the biggest hurdle. House Republicans from New York, New Jersey, and California say they won’t support the bill without a higher cap, threatening its passage.

Conservatives vs. Moderates: Senate conservatives want more drastic Medicaid cuts. Moderates warn of blowback in swing districts.

Trump vs. Reality: Trump dubbed the bill “big, beautiful, and very smart,” but Senate edits have complicated his vision.

What Happens Next?

The Senate aims to pass its version by July 4. If it does, it heads back to the House, where a heated standoff over SALT and Medicaid looms large. If changes aren’t made to appease coastal Republicans, the bill could fail before it reaches Trump’s desk. “This is the moment that could define the 2026 midterms,” says GOP strategist Ana Navarro.

FAQs

What is the SALT deduction cap?

The SALT (state and local tax) deduction cap limits how much taxpayers can deduct in local taxes. The Senate wants to reinstate the $10,000 cap.

How will the Medicaid changes affect me?

If you live in a Medicaid expansion state, your eligibility or provider access might be affected, especially in rural areas.

Is this bill likely to pass?

It’s a toss-up. SALT and Medicaid are major flashpoints, and without a compromise, the bill may die in the House.