In a dramatic reversal from months of regulatory gridlock, former President Donald Trump has cleared the way for Nippon Steel’s $14.9 billion acquisition of U.S. Steel. That move, announced over the weekend, sent Nippon Steel’s shares soaring about 3% on the Tokyo Stock Exchange Monday morning, outperforming Japan’s Nikkei index.

This deal isn’t just another corporate merger. It’s a seismic shift in the global steel industry, the U.S. manufacturing base, and geopolitics.

Nippon Steel’s Stock Is Surging Today

| Takeaway | Stat |

|---|---|

| Nippon Steel stock jumps | +3% on Tokyo exchange |

| U.S. investment pledged | $11B through 2028 + $3B for new mill |

| Production capacity boost | 63M to 86M metric tons annually |

This $14.9 billion deal is more than just a corporate acquisition. It’s a symbol of shifting economic alliances, evolving trade policies, and the growing interdependence between the U.S. and Japan. For Nippon Steel, it’s a high-stakes bet on American soil—one that markets appear ready to cheer on.

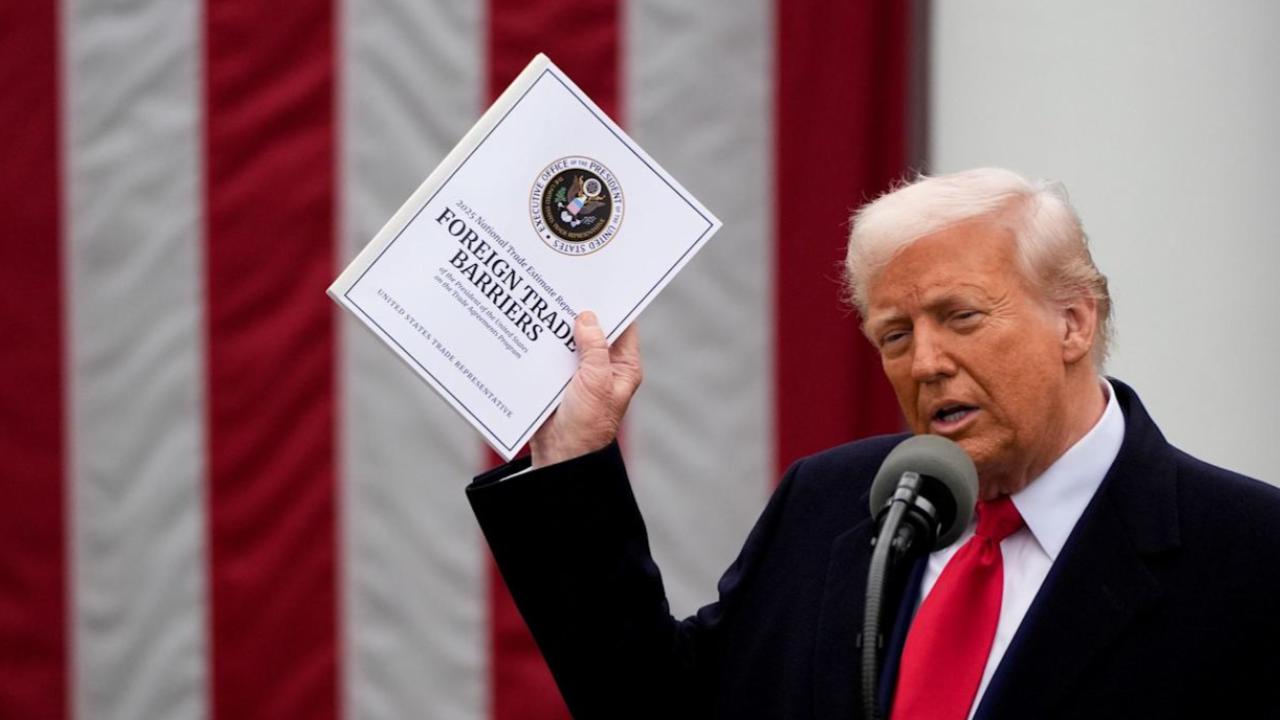

Trump’s Go-Ahead: What Changed?

The deal had been frozen under the Biden administration due to national security concerns and intense opposition from the United Steelworkers union. Trump’s decision, however, included a novel compromise: a “golden share” held by the U.S. government, giving it special veto powers over strategic decisions.

“We welcome foreign investment, but American steel must remain under American oversight,” Trump said at a rally in Pennsylvania.

Nippon Steel’s Commitment: $14 Billion in U.S. Investments

As part of the green light, Nippon Steel agreed to:

- Invest $11 billion in upgrading U.S. Steel plants by 2028

- Spend $3 billion on a new state-of-the-art steel mill

- Keep U.S. Steel’s headquarters in Pittsburgh

- Honor all existing union contracts

This commitment aims to reassure critics that the deal won’t lead to job losses or offshoring—but not everyone is convinced. “It’s still a foreign takeover, and we have to watch it closely,” said Tom Conway, president of the United Steelworkers.

Strategic Gains for Nippon Steel

By acquiring U.S. Steel, Nippon Steel will expand its annual production capacity from 63 million to 86 million metric tons. That leap gives it a competitive edge in high-end steel sectors like automotive and construction, especially in North America where demand is rising.

This merger also helps Nippon Steel hedge against sluggish domestic demand in Japan and intensifying global competition, particularly from China.

“I’ve covered the steel industry for years, and this is one of the boldest expansion plays I’ve seen,” said an industry analyst I interviewed last fall. “It’s not just about volume—it’s about value.”

Why the Market Is Bullish

Nippon Steel’s stock surge can be chalked up to three factors:

- Regulatory clarity: After 18 months of uncertainty, investors now see a clear path forward.

- Long-term growth: U.S. infrastructure needs and higher-margin products offer significant upside.

- Global positioning: The company is shifting from a domestic powerhouse to a global leader.

The Golden Share: Potential Wildcard

While the “golden share” arrangement eased U.S. concerns, it introduces a layer of political risk. The government could theoretically block certain management decisions or asset sales.

Analysts say that while this is unusual, it’s not a deal-breaker. “It’s more about optics and reassurance than real control,” one M&A attorney told Financial Times.

Trade Tensions Add Context

This deal comes on the heels of Trump’s announcement that he would double tariffs on imported steel and aluminum to 50%, up from 25%. That move is meant to bolster U.S. production and give domestic plants a leg up.

In that context, Nippon Steel’s investment-heavy approach may have been the only viable path to deal approval.

What Could Still Go Wrong?

- Financial pressure: The massive investments could squeeze Nippon Steel’s margins in the short term.

- Union backlash: Workers remain skeptical about long-term job security.

- Political swings: A future administration could alter terms or enforce the golden share differently.

Still, with the deal greenlit and a path laid out, many see more upsides than risks.