Gold‘s recent surge underscores the metal’s role as a barometer for economic sentiment. While diplomatic engagements like the Trump-Xi call offer hope, persistent economic challenges continue to drive investors toward safe-haven assets. As the global economic landscape evolves, gold’s trajectory will likely remain sensitive to both geopolitical developments and macroeconomic indicators.

Behind Gold’s Sudden Spike

| Takeaway | Stat |

|---|---|

| Gold’s Weekly Gain | +2.3% |

| US Jobless Claims | 247,000 (7-month high) |

| Trump-Xi Call Duration | 90 minutes |

| Central Bank Gold Purchases | 1,000 metric tons expected in 2025 |

Gold’s Surge Amid Economic Uncertainty

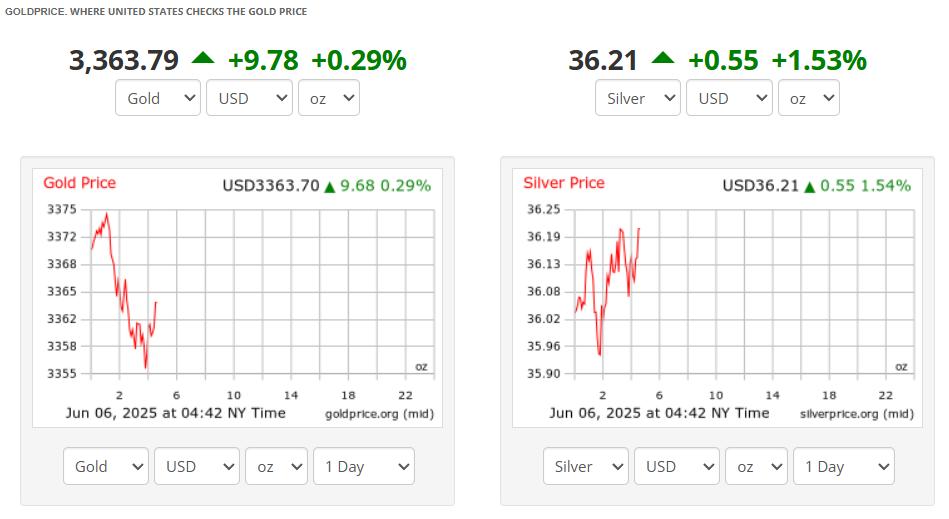

Gold prices have climbed to $3,363.33 per ounce, marking a 2.3% increase for the week. This rise is largely attributed to weak U.S. economic data, including jobless claims reaching a seven-month high of 247,000. Such indicators have heightened investor concerns about the labor market’s health and the broader economy’s trajectory.

The U.S. dollar’s recent softness has further bolstered gold’s appeal, making it more affordable for holders of other currencies.

Trump-Xi Call: A Glimmer of Hope?

On June 5, President Donald Trump and Chinese President Xi Jinping engaged in a 90-minute phone call, focusing primarily on trade issues. The discussion addressed complexities surrounding rare earth elements, essential to various high-tech industries. Both leaders described the conversation as positive, agreeing to resume high-level economic talks and extending mutual invitations for state visits.

While the call signaled a potential thaw in U.S.-China relations, it failed to resolve key issues, leaving markets cautious. Investors are now awaiting further developments from the upcoming bilateral talks.

Market Reactions and Investor Sentiment

Despite the optimistic tone of the Trump-Xi call, gold prices experienced fluctuations. Initially, the positive news led to a pullback in gold prices as risk appetite improved. However, the underlying economic concerns, particularly the weak U.S. labor data, have kept gold’s safe-haven appeal intact.

Silver, platinum, and palladium also saw movements, with silver reaching a 13-year high before retreating slightly.

Central Banks and Gold Reserves

Central banks worldwide are projected to purchase 1,000 metric tons of gold in 2025, marking the fourth consecutive year of significant acquisitions. This trend reflects a strategic shift away from dollar assets amid global economic uncertainties.

Looking Ahead: Nonfarm Payrolls and Fed Policy

All eyes are now on the upcoming U.S. nonfarm payroll report, expected to show a gain of 130,000 jobs with an unemployment rate steady at 4.2%. The report’s outcome could significantly influence market direction and Federal Reserve policy decisions.