For many seniors, the dream of owning a home and enjoying their golden years in peace can be overshadowed by the rising weight of property taxes. While it’s not a secret that taxes increase over time, seniors often find themselves in a tough spot. Fixed incomes, skyrocketing property taxes, and the pressure to maintain the home they’ve worked for decades to secure can lead to financial anxiety and even force some seniors out of their homes. But here’s the good news: there are hidden relief options that can make all the difference.

How Property Taxes Are Crushing Seniors

| Key Insight | Statistic |

|---|---|

| Rising Property Taxes | Property taxes have increased by over 20% in the last decade across the U.S. |

| Impact on Seniors | 25% of senior homeowners have struggled to pay their property taxes in the past year. |

| Relief Programs | 45 states have some form of property tax relief program for seniors. |

| Tax Deferral Benefits | Over 30 states allow seniors to defer property taxes until their home is sold or passed on to heirs. |

Property taxes may seem like an inevitable part of life, but for seniors, they can be an overwhelming challenge. Fortunately, there are numerous relief options available to help alleviate this burden. Whether through exemptions, deferrals, or local programs, taking advantage of these hidden relief opportunities can make a world of difference in keeping seniors comfortably in their homes.

By staying informed and proactive, seniors can find the financial relief they need to live out their retirement years without the constant worry of rising property taxes.

How Property Taxes Are Impacting Seniors

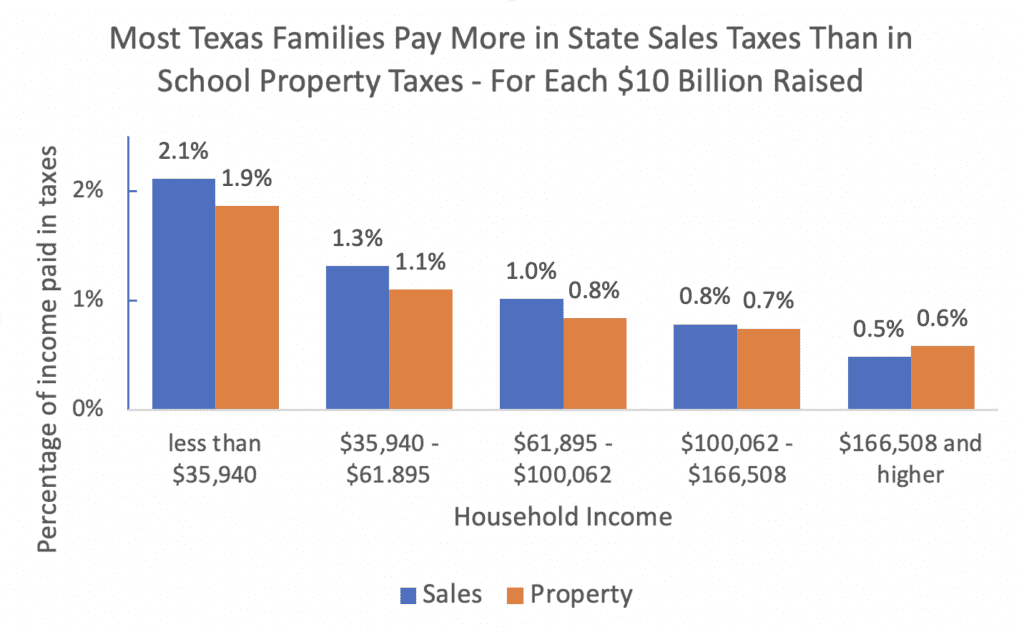

Increased property taxes are one of the most significant financial burdens that seniors face. Since property taxes are typically based on the assessed value of your home, and home values have been rising in many parts of the country, this means a senior homeowner could see an increase in taxes even if their income hasn’t risen. This situation is especially tough for those living on fixed incomes from Social Security, pensions, or savings.

Imagine you’ve lived in the same home for decades, and suddenly, your property taxes jump by hundreds, if not thousands, of dollars per year. For many, that can be enough to put a serious dent in their budget. But more than just the dollar amount, the stress of not knowing how to keep up with these increasing costs can lead to anxiety, forced decisions to sell a cherished family home, or worse, foreclosure.

The Numbers Don’t Lie

- Property Tax Increases: On average, U.S. property taxes have been climbing by more than 20% over the last ten years, outpacing inflation and wage growth for many seniors. This has led to seniors either reducing spending in other areas or, in extreme cases, losing their homes.

- Homeownership and Income: A significant number of senior homeowners (around 25%) report they are finding it difficult to keep up with their property taxes. The stress of managing property taxes can exacerbate health issues, further complicating their finances.

Hidden Ways Property Tax Relief Can Help

Despite the challenges, there are relief programs and strategies that can help seniors significantly reduce their property tax burden, sometimes even deferring or eliminating payments entirely.

- Senior Property Tax Exemptions

A growing number of states offer property tax exemptions for seniors. These exemptions can reduce the amount of taxes owed or even eliminate them altogether, depending on the state and the senior’s income level. Many states offer tax relief for seniors over the age of 65, and the relief amount often increases with age. For example, states like Florida offer a “Senior Homestead Exemption” that reduces the taxable value of your home by up to $50,000. In states like Texas, seniors can qualify for an over-65 exemption that can freeze the value of their home for tax purposes. - Deferral Programs

If you’re struggling with your current property tax bill, you may be eligible for a property tax deferral program. Instead of paying the taxes immediately, seniors can defer payment until they sell the property, transfer ownership, or pass away. This option can help seniors avoid having to choose between paying their taxes or covering essential living expenses. California, for instance, allows seniors to defer property taxes as long as the home is under a certain value. Once the home is sold or the owner passes away, the deferred taxes are repaid from the sale proceeds. - Tax Circles and Refund Programs

In some states, seniors may qualify for property tax refunds or circles, where they can receive a percentage of their taxes back based on income, disability, or other factors. In New Jersey, seniors with low incomes can apply for the Property Tax Reimbursement Program, which reimburses them for part of the taxes they paid. - State and Local Programs

Many local governments have their own initiatives designed to offer property tax relief. For example, some counties offer sliding scale property taxes, while others may offer homestead credits or other forms of direct assistance to seniors. Always check with your local tax assessor’s office to learn about relief programs that may be specific to your area.

Navigating the System: How to Access Relief

While relief programs are available, many seniors don’t know they exist or don’t understand how to apply. Here’s how you can navigate the system to access relief:

- Step 1: Start with Research

Visit your local government’s website and search for “property tax exemptions” or “property tax relief for seniors.” Most counties and states have dedicated sections for senior citizens that detail available programs. - Step 2: Gather Your Documents

You’ll typically need proof of age, income, and residency. For deferral programs, you may also need proof of your home’s value and other financial information. - Step 3: Apply on Time

Many relief programs have application deadlines. Be sure to apply early to ensure you don’t miss out on any opportunities. - Step 4: Ask for Assistance

If you have trouble navigating the application process, don’t hesitate to ask for help. Many states have local agencies that assist seniors with applying for property tax relief. It may also be helpful to contact organizations like AARP for additional resources.

Case Study: How Relief Helped One Senior

Take the case of Sarah, a 72-year-old woman living in Austin, Texas. She had lived in her home for over 40 years, but the rising property taxes were becoming too much for her to bear. After researching available options, Sarah applied for the Texas Over-65 Homestead Exemption. This exemption reduced her property’s taxable value by $25,000, significantly lowering her annual property tax bill. In addition, Sarah qualified for a tax deferral, meaning she could delay paying her property taxes until she decided to sell her home. This allowed Sarah to stay in her home, worry-free, and continue living the life she had worked so hard to build.

FAQs

What is a property tax exemption for seniors?

A property tax exemption for seniors is a reduction in the taxable value of your home. Many states and local governments offer these exemptions for seniors over a certain age (usually 65 and older), and in some cases, you may qualify for a full exemption if your income is low.

Can seniors defer property taxes?

Yes, many states and local governments offer property tax deferral programs for seniors. This means that you can delay paying your property taxes until you sell your home, transfer ownership, or pass away. The deferred taxes will need to be paid when the home is sold.

How do I apply for property tax relief programs?

Each state and locality has different application procedures. Typically, you will need to visit your local tax assessor’s website or office, fill out an application, and submit documents such as proof of age and income.