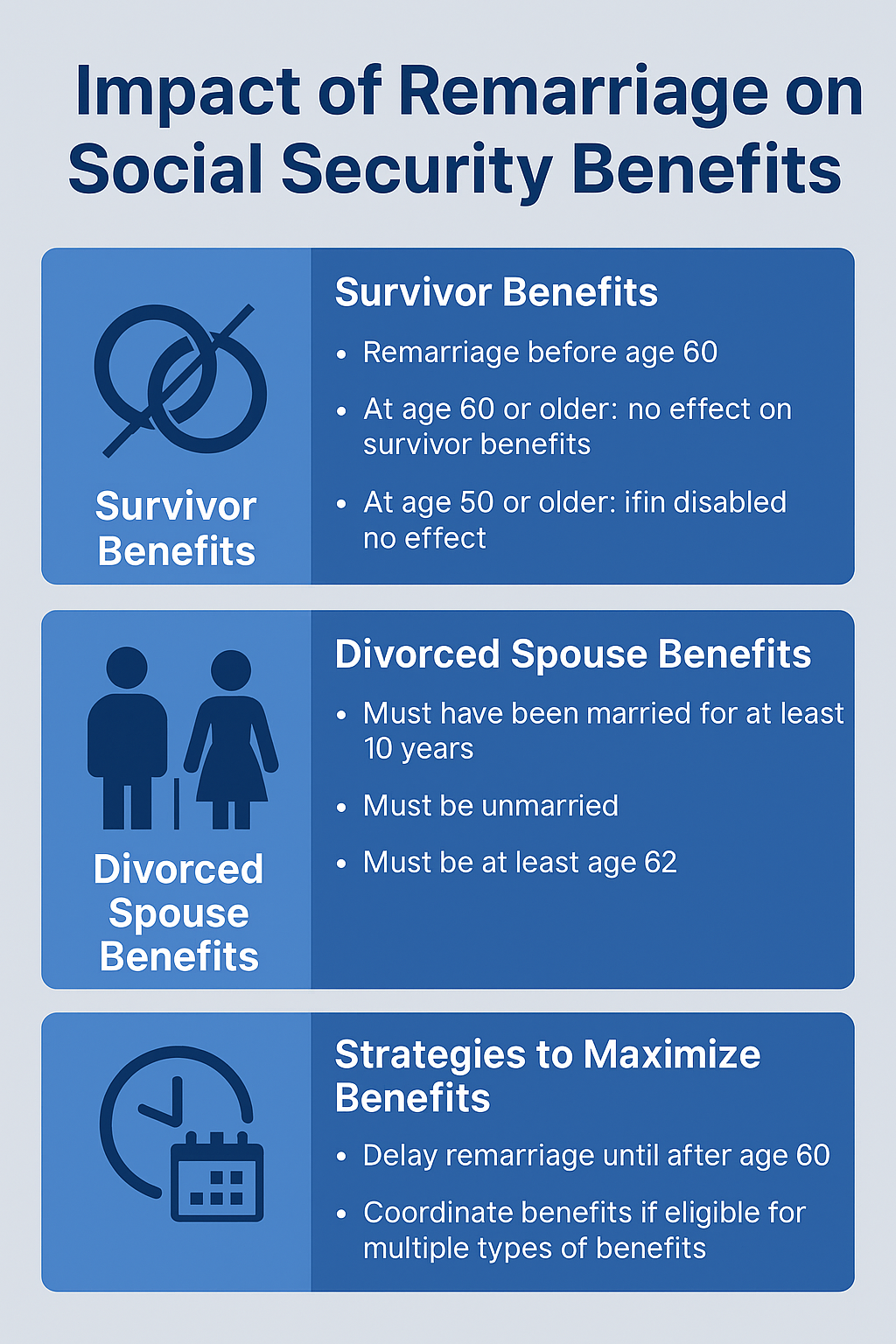

Thinking about tying the knot again? If you’re a widow or divorcée, remarriage could significantly impact your Social Security benefits. Understanding these nuanced rules is crucial to avoid unexpected financial pitfalls and ensure you’re making informed decisions about your future.

The Hidden Rules of Social Security

| Takeaway | Stat |

|---|---|

| Remarrying before age 60 can forfeit survivor benefits | Remarriage before 60 disqualifies you from collecting survivor benefits on a deceased spouse’s record |

| Divorced spouses can claim benefits after 10 years of marriage | Must be married for at least 10 consecutive years to qualify for ex-spouse benefits |

| Remarriage after age 60 preserves survivor benefits | Remarrying at 60 or older allows you to retain survivor benefits from a deceased spouse |

Navigating Social Security benefits as a widow or divorcée requires careful consideration, especially when contemplating remarriage. Understanding the rules and timing your decisions can have significant financial implications. Consult with a Social Security representative or financial advisor to make choices that best suit your circumstances.

How Remarriage Affects Social Security Benefits

Survivor Benefits for Widows and Widowers

If you’re receiving survivor benefits based on a deceased spouse’s record, remarrying can affect your eligibility:

- Before age 60: Remarrying will generally disqualify you from receiving survivor benefits.

- At age 60 or older: You can remarry without losing survivor benefits.

- At age 50 or older and disabled: Remarrying after 50 won’t affect your eligibility for disabled widow(er)’s benefits.

These rules are designed to provide financial support to surviving spouses, but timing is critical.

Benefits for Divorced Spouses

If you’re divorced, you may be eligible for benefits based on your ex-spouse’s record:

- Marriage duration: Must have been married for at least 10 consecutive years.

- Current marital status: Must be unmarried to claim benefits on an ex-spouse’s record.

- Age: Must be at least 62 years old.

Remarrying generally disqualifies you from receiving benefits based on your ex-spouse’s record unless the subsequent marriage ends.

Strategies to Maximize Your Benefits

Delaying Remarriage

If you’re approaching age 60 and considering remarriage, waiting until after your 60th birthday can preserve your eligibility for survivor benefits.

Coordinating Benefits

If you’re eligible for multiple types of benefits (e.g., your own retirement benefit and a survivor benefit), strategize the timing of claims to maximize your total benefits over time.

Real-Life Scenario

Consider Jane, a 59-year-old widow receiving survivor benefits. She’s planning to remarry. If she marries before turning 60, she’ll lose her survivor benefits. By waiting until after her 60th birthday, she can remarry and retain those benefits, ensuring continued financial support.

Frequently Asked Questions

Can I receive benefits from both my ex-spouse and current spouse?

No, you can only receive benefits from one spouse at a time. The Social Security Administration will pay the higher of the two benefits for which you’re eligible.

What happens if I remarry after age 60?

Remarrying after age 60 does not affect your eligibility for survivor benefits from a deceased spouse.

If I remarry and then divorce, can I reclaim benefits from my previous spouse?

Yes, if your subsequent marriage ends, you may become re-entitled to benefits on your prior deceased spouse’s record.