Hold tight—President Trump has just announced a bold economic move: a 50% tariff on all imported steel and aluminum. This isn’t just political fireworks—it could raise prices on everything from your next car to your favorite soda. Whether you’re a shopper, small business owner, or investor, this decision is about to get real personal. Let’s break it all down: what these new tariffs mean, how they’ll affect prices, who’s winning, and who’s sweating.

Trump Just Slapped 50% Tariffs on Steel & Aluminum

| Topic | Details |

|---|---|

| What Happened | Trump announced 50% tariffs on imported steel and aluminum |

| Effective Date | Tariffs begin June 4, 2025 |

| Impacted Sectors | Auto, construction, food packaging, appliances |

| Expected Consumer Impact | Price hikes on cars, canned goods, electronics, building materials |

| Biggest Winners | U.S. steel companies like Nucor, U.S. Steel, Steel Dynamics |

| Potential Retaliation | Canada and the EU may impose counter-tariffs |

Trump’s new 50% steel and aluminum tariffs are no joke—they’re a direct hit to the supply chain, consumer prices, and possibly international diplomacy. Whether you’re trying to buy a new car, remodel your house, or keep your small business afloat, this move could change your plans—and your budget. It’s not just politics—it’s your wallet. And it’s happening now.

Why Is Trump Doing This—Again?

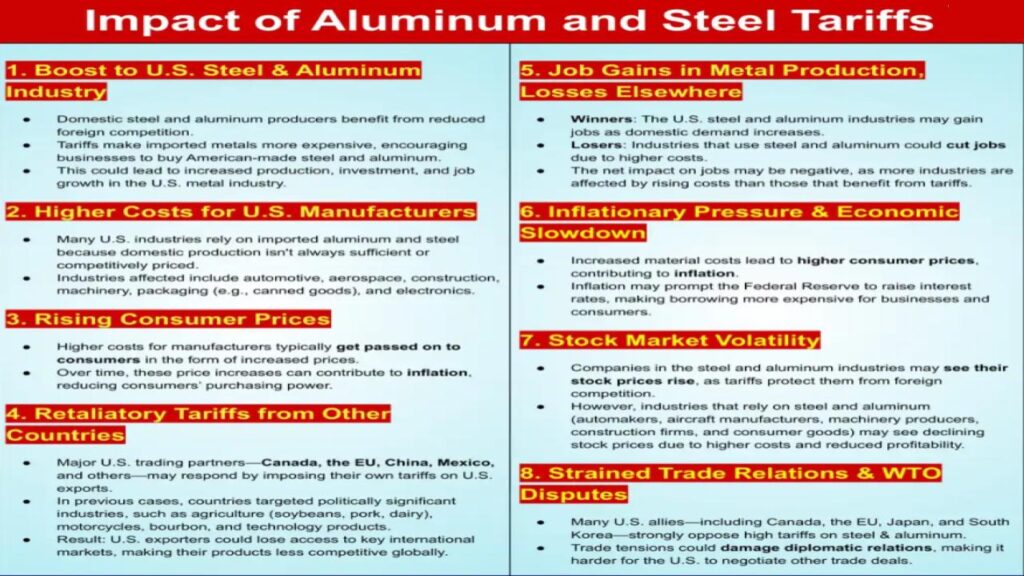

This is part of Trump’s familiar “America First” strategy. In his first term, he imposed a 25% tariff on imported steel. Now, he’s doubling it to 50%, claiming that unfair global trade is harming U.S. industry. Trump’s team says this will boost domestic manufacturing and cut dependency on nations like China.

But while that might sound patriotic, history—and experts—suggest the economic fallout could be complicated.

How Will This Impact Everyday Americans?

Rising Prices on Everyday Goods

This isn’t just about factories and politics—it’s about your shopping bill. Here’s where the ripple effect will show up fast:

- Canned Food and Beverages: Aluminum is essential in packaging. If it costs more, so do your groceries. Think Coca-Cola, beer, soup, even tuna.

- Cars and Trucks: Auto manufacturers like Ford, GM, and Toyota use tons of imported steel. Expect car prices to jump.

- Appliances: Refrigerators, washing machines, and dryers—many rely on foreign steel parts.

- Home Construction: Building a house? Steel beams, siding, and HVAC systems are about to get pricier.

According to the Peterson Institute for International Economics, Trump’s 2018 steel tariffs (which were just 25%) led to a 9% spike in U.S. steel prices. Now that rate has doubled—meaning sharper, faster increases for you.

Will American Jobs Actually Benefit?

That depends on which jobs you’re talking about. Steelmakers may see gains, but companies that rely on steel and aluminum could face layoffs due to higher costs.

- Auto plants may reduce output.

- Construction firms could slow hiring.

- Small manufacturers that can’t afford increased materials may downsize.

This already happened back in 2018 when Harley-Davidson shifted some production overseas to dodge tariffs. So while steel jobs might go up, other sectors could suffer.

Could This Spark a New Trade War?

Canada, Europe, and China Are Not Happy

Canada supplies more steel and aluminum to the U.S. than any other country. Naturally, they’re not thrilled. Their government called the new tariffs “an act of economic aggression.”

The European Union is already threatening countermeasures and may escalate the issue to the World Trade Organization (WTO). China, though quieter, is likely watching closely and preparing a response.

Retaliation could include:

- Tariffs on U.S. exports like soybeans, whiskey, or electronics.

- Delays at ports and tighter regulations for U.S. companies abroad.

- WTO disputes that drag on for years.

So yeah—trade war vibes are back.

What’s Happening in the Stock Market?

Wall Street has already responded. Some stocks are up, some are wobbling. Here’s a snapshot:

- United States Steel Corp. (X): Up 1.1%

- Nucor Corp. (NUE): Slightly up 0.3%

- Alcoa (AA): Down 3% due to global supply concerns

- Steel Dynamics (STLD): Mixed performance

- Ford & GM: Dropped slightly due to higher production costs

If you’re invested in industrials or automakers, this is a good time to re-evaluate your positions.

What You Should Do Right Now

For Shoppers and Homeowners

- Buy sooner, not later: Big-ticket items like cars, electronics, and appliances are likely to go up in price.

- Hold off on construction: If you’re planning a major renovation, it may be smart to wait for price clarity.

For Small Business Owners

- Review your supply chain: Do you rely on imported metals? Time to explore domestic alternatives.

- Communicate with your customers: Price hikes may be necessary—but don’t let them surprise your buyers.

For Investors

- Watch steel stocks: U.S. steel companies might see a short-term bump.

- Monitor ETFs like XLI and SLX: They track industrials and steel.

- Be cautious with automakers and appliance brands: Their margins could get squeezed.

Is This Even Legal?

Yes—under Section 232 of the Trade Expansion Act of 1962, the president can impose tariffs if national security is at risk. That’s the same law Trump used in 2018.

But it’s controversial. Several legal challenges are already in the works. Congress could attempt to reverse it, but that’s unlikely without bipartisan outrage.

If Trump stays in office—or wins reelection in November—these tariffs are here to stay.

Frequently Asked Questions (FAQs)

Why did Trump double the tariffs?

Trump doubled the tariffs on steel and aluminum to protect U.S. manufacturing and punish what he calls “unfair trade practices” by countries like China. His administration argues that foreign producers—especially in Asia—are flooding global markets with cheap, subsidized steel and aluminum, undercutting American jobs and businesses.

How soon will I feel the impact?

You could start feeling the impact of Trump’s 50% steel and aluminum tariffs within just a few weeks to a few months—especially in industries like construction, automotive, food packaging, and appliances.

Will jobs increase in the U.S.?

Maybe in the steel industry, but other sectors—like automotive, manufacturing, and construction—may face layoffs due to higher input costs.

Could prices go down again later?

Possibly, but only if tariffs are rolled back or global supply chains adjust. That could take years.

Will other countries retaliate?

Yes, several countries have already announced or implemented retaliatory measures in response to President Trump’s decision to double tariffs on imported steel and aluminum to 50%. These actions are escalating trade tensions and could have significant economic implications.