Retiring with a cool $1.5 million in the bank and Social Security benefits rolling in might make you feel like you’ve finally made it. But hold up—depending on where you live, that sweet retirement nest egg could vanish faster than you think. With prices climbing and cost of living varying drastically across states, your location could be the make-or-break factor in how long your money lasts.

According to a fresh analysis by GOBankingRates, the combination of $1.5 million in savings plus average Social Security payouts doesn’t stretch equally across the map. Some states let your retirement dollars breathe easy, while others eat them alive. Let’s dig into the numbers, figure out what’s going on, and help you make the smartest call about where to spend your golden years.

How Fast $1.5M + Social Security Can Disappear by State

| Factor | Details |

|---|---|

| Savings Analyzed | $1.5 million retirement savings + average Social Security income |

| Top States for Longevity | West Virginia (54 years), Kansas (52), Mississippi (51), Oklahoma (51) |

| Worst States for Longevity | Hawaii (17 years), Massachusetts (23), California (24), New York (29) |

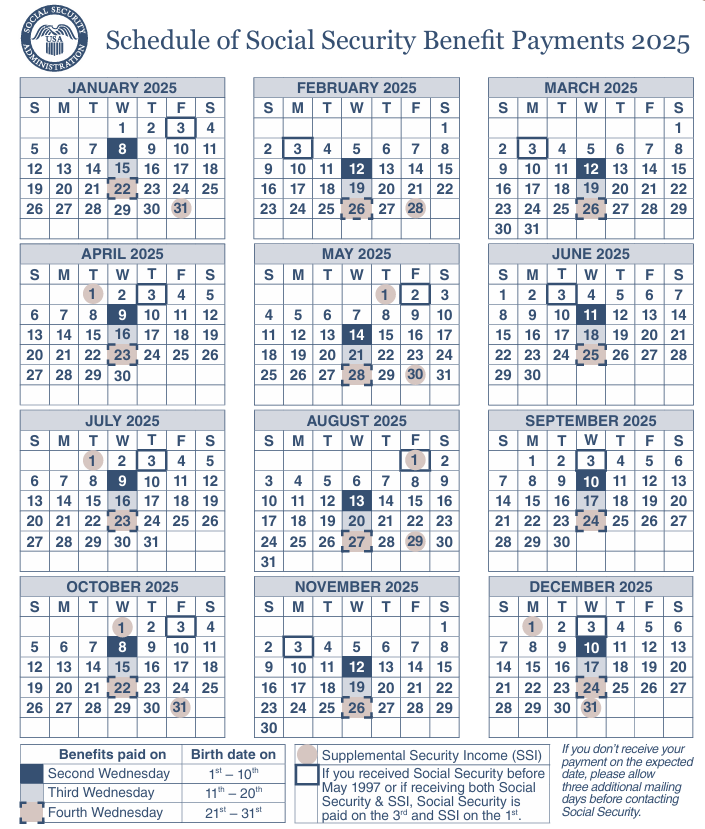

| Social Security Avg. Monthly | $1,841 (as of 2024, SSA.gov) |

| Living Cost Gap | More than $55,000 annual difference between cheapest and most expensive states |

| Official Reference | ssa.gov |

$1.5 million might feel like a jackpot, especially when paired with Social Security, but location makes all the difference. If you’re retiring in a state with a low cost of living, your money can stretch for decades. But in high-cost areas, you could be running on fumes in under 20 years. Plan smart, pick your retirement spot wisely, and keep tabs on your spending. Because at the end of the day, it’s not just what you save—it’s where you spend it.

Why Retirement Longevity Varies by State

The main factor at play here is cost of living. Everything from housing and groceries to healthcare and taxes adds up differently across the U.S. So, while you might be comfy sipping sweet tea on a porch in Mississippi, the same lifestyle could burn through your cash in half the time in Hawaii.

Social Security, though steady, isn’t indexed by state. You’ll receive the same federal benefit regardless of where you live—but your rent, gas, and utilities definitely aren’t fixed.

Real Example: Retirement in West Virginia vs. California

- West Virginia: Annual post-Social Security expenses = ~$27,803

Retirement savings last: 54 years - California: Annual post-Social Security expenses = ~$63,795

Retirement savings last: 24 years

That’s a whopping 30-year gap just based on zip code.

Top 5 States Where $1.5M Lasts the Longest

If stretching your dollar matters most, these states are retirement gold mines. They combine low housing costs, tax advantages, and reasonably priced healthcare to give you the biggest retirement runway.

1. West Virginia – 54 Years

- Annual expenses (after Social Security): ~$27,803

- Why it lasts: Super low home prices, minimal healthcare costs, and no state tax on Social Security. It’s peaceful, with decent access to city comforts if you stick near Charleston or Morgantown.

2. Kansas – 52 Years

- Annual expenses: ~$28,945

- Why it lasts: Real estate is affordable, taxes are retiree-friendly, and small-town charm mixes with urban benefits in cities like Wichita or Topeka.

3. Mississippi – 51 Years

- Annual expenses: ~$29,426

- Why it lasts: Dirt-cheap cost of living and zero state tax on Social Security. A great place for those who don’t mind the Southern heat and prefer laid-back living.

4. Oklahoma – 51 Years

- Annual expenses: ~$29,666

- Why it lasts: Consistently low prices on food, rent, and healthcare. Cities like Tulsa and OKC offer retirees everything they need without financial pressure.

5. Alabama – 50 Years

- Annual expenses: ~$30,207

- Why it lasts: Warm weather, affordable housing, and retirement tax perks make this Southern state a smart pick. Huntsville and Birmingham balance cost and lifestyle well.

Top 5 States Where You’ll Burn Through Retirement Fast

These states are stunning, culturally rich, and exciting—but they’re also expensive. If your goal is to make your money last, you’ll want to think twice before retiring here unless you’ve got serious backup funds.

1. Hawaii – 17 Years

- Annual expenses (after Social Security): ~$87,770

- Why it drains fast: Paradise comes at a steep price. Food, housing, and utilities are some of the most expensive in the U.S. Even with Medicare, healthcare can cost a premium.

2. Massachusetts – 23 Years

- Annual expenses: ~$65,117

- Why it drains fast: High housing and medical care costs are the culprits. Even though the state offers decent senior programs, they don’t do enough to offset the steep expenses.

3. California – 24 Years

- Annual expenses: ~$63,795

- Why it drains fast: Sky-high real estate and taxes make California beautiful but budget-busting. While some areas offer retiree discounts, it’s still an uphill battle to make savings last.

4. New York – 29 Years

- Annual expenses: ~$50,997

- Why it drains fast: NYC’s high cost of living skews the whole state upward. Add local taxes, expensive housing, and transportation, and your retirement funds dwindle fast.

5. Alaska – 30 Years

- Annual expenses: ~$50,000+

- Why it drains fast: Everything has to be shipped in. Heating and medical costs are much higher than average. Isolation also adds emotional and travel expenses that add up over time.

How Social Security Fits Into the Equation

As of 2024, the average Social Security retirement benefit sits at about $1,841/month. That gives you $22,092/year to work with. In low-cost states, that covers nearly 75-80% of your expenses. In high-cost states like Hawaii, it barely scratches 25%.

If you’re banking on Social Security to carry your retirement, you need to factor in where it goes the furthest.

“Your retirement lifestyle is determined less by your savings total and more by your spending habits and location,” says certified financial planner Diane Pearson. “Where you live dictates how long your savings last.”

Tips to Stretch $1.5 Million in Retirement

Even in high-cost areas, smart planning can help you make the most of your money.

Downsize Early

Sell your large home while the market is strong and move to a smaller, more affordable one. Bonus: Less maintenance stress.

Choose a Tax-Friendly State

Some states have no tax on Social Security or retirement withdrawals. Look for:

- Florida

- Nevada

- South Dakota

- Wyoming

Delay Social Security

If you can, hold off claiming until age 70. Your benefit grows by about 8% per year past full retirement age.

Use the 4% Rule Wisely

Withdraw no more than 4% of your retirement savings annually to avoid running out too soon.

Consider Senior Living Hubs

Places like The Villages in Florida or Sun City in Arizona offer discounts, safety, and social perks.

What Happens If You Run Out Early?

Nobody wants to outlive their money. But if it happens, here are some fallback options:

- Part-time work: Remote or flexible gigs like tutoring, consulting, or pet sitting

- Reverse mortgage: Tap home equity if you own property

- Annuities: Guaranteed income, but choose wisely—some come with high fees

- Government aid: Programs like SSI, Medicaid, and housing subsidies

Frequently Asked Questions (FAQs)

How much should I aim to save for retirement?

While $1.5 million is often touted as the magic number, your actual target should be 25x your annual expenses.

Can I retire comfortably on just Social Security?

Unlikely in most states. Social Security was designed to supplement, not replace, retirement savings.

Is it better to move before or after retirement?

It’s usually better to move before. That way, you can sell your home, adjust to your new budget, and access local support systems.

What states are best for tax-free retirement?

Florida, Texas, and Tennessee top the list with no state income tax.

What about healthcare costs?

Don’t underestimate them—Medicare doesn’t cover everything. Consider a Medigap or Medicare Advantage plan.