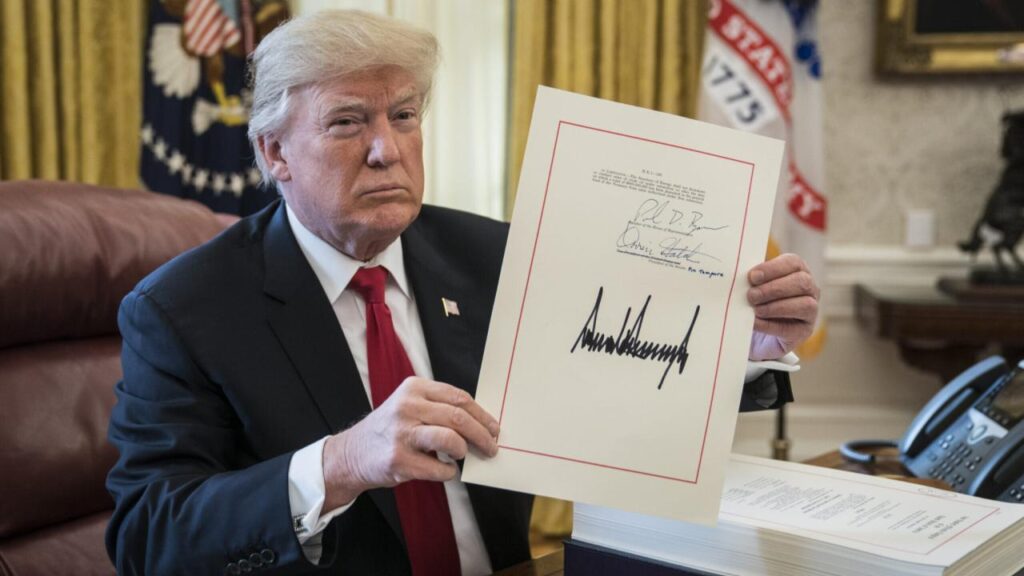

When it comes to taxes, things can get real complicated, real quick. But let’s keep it simple: Trump’s tax bill—officially called the One Big Beautiful Bill—just passed a big vote in the House Budget Committee, and it could seriously shake up how much money stays in your pocket.

On May 18, 2025, the bill squeaked by with a 17-16 vote, moving it closer to a full vote in the House and possibly a Senate showdown. If you’re a worker, retiree, or even a small business owner, this one’s gonna hit home.

So what’s inside this big flashy tax package? Will it boost your refund—or burn a hole in your benefits? Let’s break it all down.

Trump’s Tax Bill Just Cleared a Major Hurdle

| Topic | Details |

|---|---|

| Bill Name | One Big Beautiful Bill |

| Latest Update | Passed House Budget Committee on May 18, 2025 |

| Main Provisions | Extension of 2017 tax cuts, tax exemptions for tips and overtime, higher SALT cap, senior deductions |

| Target Groups | Working-class Americans, retirees, high-tax state residents |

| Fiscal Concerns | Estimated cost: $3–5 trillion over 10 years |

| Spending Cuts | Medicaid, SNAP, and other aid programs |

| Next Step | Heads to House Rules Committee, then full House vote |

So here’s the deal: Trump’s tax bill just dodged its first bullet, and if it makes it through Congress, it could leave you with more money in your wallet—or less access to critical services, depending on your situation.

For many Americans, the proposal offers a mix of relief and risk. Whether you’re racking up overtime or stretching retirement dollars, it’s worth keeping tabs on what happens next. Because when taxes change, your life changes too.

What’s in Trump’s New Tax Bill?

Trump’s bill is a mixed bag of tax cuts, benefits, and spending slashes. Here’s what it’s offering:

1. Making the 2017 Tax Cuts Permanent

Back in the day, Trump’s Tax Cuts and Jobs Act (TCJA) gave folks lower income tax rates and a higher standard deduction. But those perks are set to expire at the end of 2025.

This bill locks them in permanently. That means most Americans will keep paying lower taxes compared to pre-2017 rates.

Example: A married couple earning $80,000 might continue to pay a lower 12% tax rate instead of jumping back to 15%.

2. No Federal Taxes on Tips, Overtime & Auto Loan Interest

Trump wants to eliminate federal income tax on:

- Tips

- Overtime pay

- Interest on auto loans (if the car was made in the USA)

This could be a game-changer for service industry workers, factory employees, and mechanics who log those extra hours.

“I pull doubles at the diner on weekends—cutting taxes on tips? That’s money I need to pay rent,” says Maria, a waitress in Ohio.

3. Higher SALT Deduction Cap

Currently, you can only deduct up to $10,000 in state and local taxes (SALT) from your federal taxes. That’s rough if you live in high-tax places like New York or California.

This bill raises the SALT cap to:

- $30,000 for joint filers

- $15,000 for single filers

That’s sweet relief for homeowners and professionals in those states.

4. Bigger Deductions for Seniors

Seniors making under $75,000 would see higher standard deductions, meaning less taxable income and bigger refunds.

Think: More money left for groceries, meds, or even that summer road trip to see the grandkids.

Where’s the Money Coming From? (And What’s the Catch?)

Not everything in this bill smells like roses.

Estimated Cost: $3–5 Trillion

According to Reuters, if these tax cuts stick around, we’re looking at a $3 to $5 trillion tab added to the national debt over the next decade.

So, how does the bill plan to pay for all this?

Spending Cuts to Medicaid and SNAP

That’s where it gets dicey. The bill proposes $1.5 trillion in spending cuts, hitting:

- Medicaid (healthcare for low-income Americans)

- SNAP (a.k.a. food stamps)

- Housing aid and nutrition programs

This has already fired up debates in Congress. Some Republicans want even deeper cuts, while Democrats and moderate GOP reps say it’s gonna hurt the most vulnerable.

How This Impacts YOU

Let’s keep it real. Whether you’re a blue-collar worker, a retiree, or just trying to survive on a budget—this bill could hit you in different ways.

If You’re Working in the Service Industry

No federal tax on tips or overtime means more take-home pay every week. That’s straight cash in your pocket.

If You’re a Retiree

The extra deductions could lower your tax bill. But if you rely on Medicaid or SNAP, those cuts might hurt more than help.

If You Live in a High-Tax State

That boosted SALT deduction could save you thousands come tax time.

If You Rely on Federal Aid

The Medicaid and SNAP cuts may mean less access to healthcare or groceries. Advocates warn of rising costs for low-income families.

What Happens Next?

The bill now moves to the House Rules Committee, where amendments may be tossed in. If it clears that stage, it’ll head for a full House vote.

If it passes there, it still needs to survive the Senate. Some senators, even Republicans, are worried about ballooning deficits and deep spending cuts.

Budget reconciliation rules mean the Senate could pass it with just 51 votes—but one defection could tank it.

So yeah, buckle up—it’s gonna be a wild ride in D.C.

Breaking: Former President Joe Biden Battles Aggressive Prostate Cancer

Wholesale Prices Just Dropped—So Why Are Your Groceries Still Getting Pricier?

Google’s First Texas Store Is Opening Soon — Here’s What You Need to Know

Frequently Asked Questions (FAQs)

Q1: What is the “One Big Beautiful Bill”?

It’s Trump’s proposed tax and spending reform for 2025, designed to make permanent tax cuts from 2017 and introduce new exemptions for workers.

Q2: Will my taxes go down if this passes?

Likely yes, especially if you:

- Work for tips or do overtime

- Own a home in a high-tax state

- Are retired with income under $75,000

Q3: Who could lose benefits under this bill?

Low-income Americans using programs like Medicaid and SNAP may see reduced support if the spending cuts go through.

Q4: Is this bill already law?

Nope—not yet. It’s passed the House Budget Committee, but still needs full House and Senate approval.

Q5: Where can I read the bill text or updates?

Check out the official Congress.gov page or the CBO.gov for cost analyses and bill status.