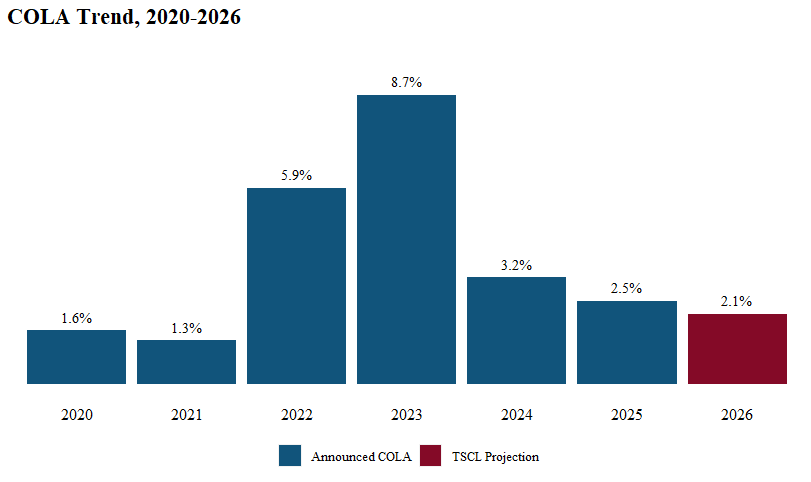

If you rely on Social Security to help cover your bills, brace yourself. The 2026 Social Security COLA—the cost-of-living adjustment that tweaks your monthly benefit—looks set to rise just 2.5%. That’s not nothing, but it’s a far cry from the big boosts we saw just a couple of years back. And for many retirees, that modest increase might not go nearly far enough.

2026 Social Security COLA

| Takeaway | Stat |

|---|---|

| Projected COLA for 2026 | 2.5% |

| Average year-over-year CPI-W rise | 2.2% |

| Estimated monthly boost for typical retiree | ~$49 |

| Historical context | 8.7% (2023 COLA) |

| Cost hotspots | Housing, food, medical care |

If the forecasts hold, the 2026 Social Security COLA will come in at around 2.5%—a modest increase by recent standards. But with prices for food, housing, and health care still rising, many retirees could feel squeezed. It’s a reminder that COLA doesn’t always equal cost-of-living relief.

What’s Driving the 2.5% COLA?

COLA calculations aren’t based on your rent, your groceries, or your prescriptions. Instead, they come from a government inflation metric called the CPI-W—short for the Consumer Price Index for Urban Wage Earners and Clerical Workers. It tracks what working Americans are spending, not necessarily retirees.

For 2026, the CPI-W has risen just 2.2% over the past year. That points to a projected COLA of 2.5%, according to the nonpartisan Senior Citizens League and Social Security analyst Mary Johnson. They’ve nudged their forecast up slightly from earlier estimates of 2.4%.

“This projection reflects very modest inflation, but many seniors tell us their actual costs are far higher,” said Johnson in an interview with MarketWatch.

Real Costs vs. Reported Inflation

Let’s break it down. CPI-W might say inflation is cooling, but everyday essentials tell a different story. Housing prices are still climbing. Health care premiums are ticking up. And groceries? Well, anyone who’s been to a supermarket lately knows that cereal, eggs, and produce aren’t getting any cheaper.

This mismatch is why many retirees feel shortchanged. The COLA might technically keep up with CPI-W, but not with your reality.

Here’s the kicker: data collection itself may be falling short. The Bureau of Labor Statistics, the agency that produces the CPI, is facing staffing issues that could affect the quality of its numbers. Fewer data collectors mean potential blind spots—especially in rural or underserved areas.

Could Tariffs Tip the Scales?

Another wrinkle in the COLA forecast? Tariffs.

If new or expanded trade tariffs kick in later this year, we could see a late bump in inflation. That matters because the official COLA number is based on the average CPI-W from July through September 2025. If prices rise sharply during that window, retirees might see a slightly higher adjustment. But that’s a big “if.”

“Tariffs are the wild card,” said economist John Leer of Morning Consult. “They can push prices up quickly, but it depends on timing and enforcement.”

How Much Will You Actually Get?

Here’s the math: the average monthly Social Security check in 2025 is projected to be about $1,948. A 2.5% COLA bumps that up by roughly $49 a month, or $588 a year.

Sure, it’s better than nothing. But it pales in comparison to the 5.9% bump in 2022 and the whopping 8.7% hike in 2023—when inflation was running wild.

What Retirees Can Do Now

Adjust your expectations

With inflation easing, we’re not likely to see huge COLA increases anytime soon. Build your 2026 budget with a modest boost in mind.

Track your spending

Knowing where your money actually goes can help you make smarter trade-offs—especially if essentials keep rising faster than your benefits.

Look into other income streams

Whether it’s drawing from savings, a part-time gig, or help from local programs, a little extra income can make a big difference.

Push for reform

Advocates are calling for COLAs to be tied to a different index—like the CPI-E, which tracks expenses more relevant to older Americans. That change won’t happen overnight, but public pressure could speed things up.

What’s Next?

The official 2026 COLA will be announced in mid-October 2025, after the government crunches inflation data from the third quarter. Until then, expect small updates to the forecast, but nothing dramatic unless tariffs or energy prices spike.

From covering COLA changes year after year, I can tell you this: the number rarely tells the whole story. Retirees live the real inflation rate, and that doesn’t always show up in Washington’s spreadsheets.